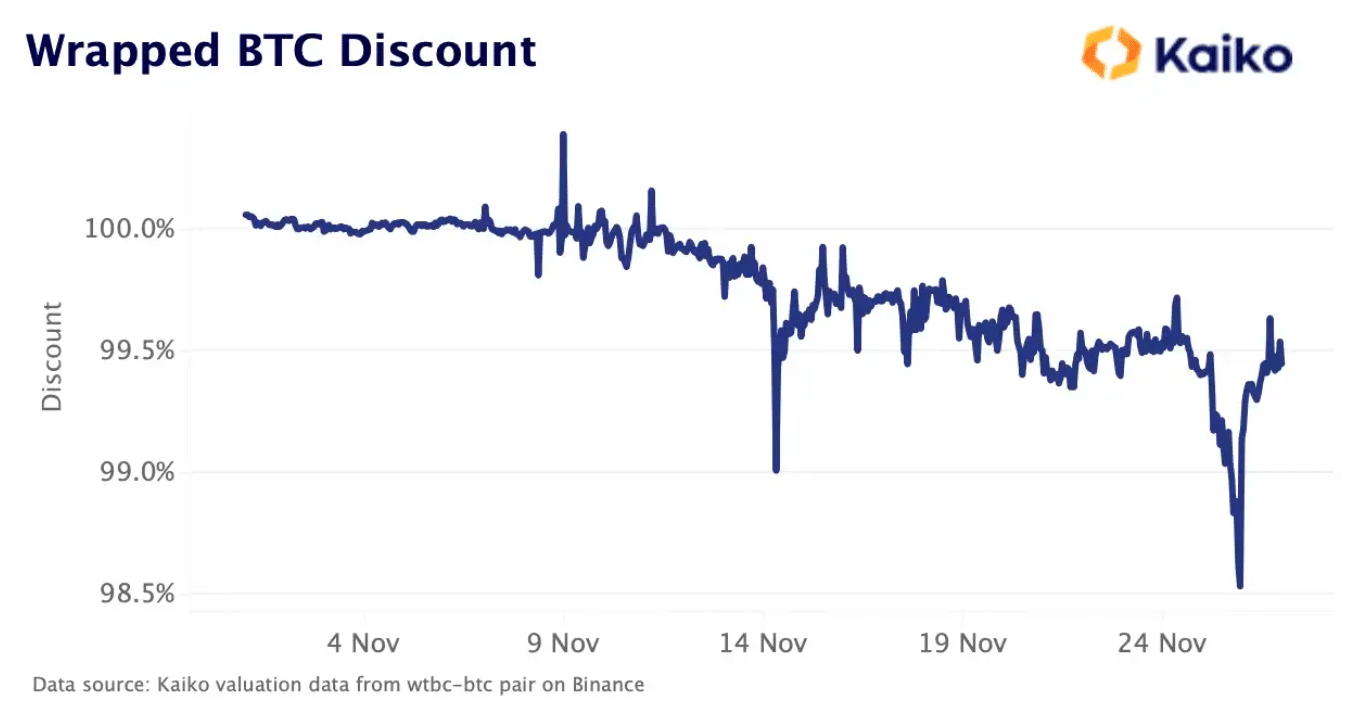

A continued discount on Wrapped Bitcoin (WBTC) – the largest wrapped version of Bitcoin – has market participants on edge.

According to a Nov. 28 report from Kaiko, the last week has seen a “confidence crisis” for wrapped crypto assets. The firm pointed to WBTC’s persistent discount to Bitcoin of -1.5% on Nov. 25 as an example of this.

WBTC is an ERC-20 token that represents Bitcoin on Ethereum. Theoretically, the token should always equal one BTC given the fact that it is backed 1:1 by Bitcoin – something that WBTC’s official custodian BitGo confirmed over the weekend. At the time of writing, WBTC’s discount sits at 0.5% to BTC.

Fears around WBTC not being fully backed stemmed from rumors that 100,000 WBTC was minted by Alameda Research – the quantitative trading firm tied to insolvent crypto exchange FTX.

“The crypto misinformation HAS TO STOP. This isn’t how WBTC works. Alameda was a ‘WBTC merchant’ which means they’d accept BTC from customers and send it to BitGo to mint WBTC,” tweeted crypto industry watcher Udi Wertheimer on Saturday. He explained that Alameda never custodied BTC themselves and WBTC’s reserves can be verified on-chain.

The rumor-driven lapse in confidence in WBTC led some members of the crypto community to joke about the insolvency of Wrapped Ethereum (WETH) as well. A number of popular Crypto Twitter accounts circulating the inside joke led to a considerable degree of confusion over the weekend, particularly for those who didn’t detect the sarcasm.

Ethereum community member Hudson James took to Twitter to clarify that WETH was not, in fact, in any trouble. James explained that WETH is a smart contract that gives the user an equal amount of ETH back and does not deviate from the price of the asset. Moreover, WETH is not stored by a centralized exchange or group, meaning that its backing depends on the integrity of the token contract rather than a custodian.

“The WETH jokes today play on the fact that WETH is an ERC-20 token that is impossible to go insolvent (besides an unlikely contract flaw) and will always be backed 1-to-1 by the ether deposited by the you,” said James in a tweet on Sunday.