YFI and YFII, explained.

Given the macro environment plus the halving this past spring, it seemed inevitable that the Bitcoin price would rise. But perhaps the announcement last week that banks could now custody crypto, or DeFi gains making their way back to the original cryptocurrency, were the factors that finally tipped the price past $10,000.

Meanwhile, Ethereum celebrated its fifth birthday, which creator Vitalik Buterin and his father Dmitry discussed on both podcasts. If you’re looking to understand Ethereum 2.0 as it approaches, we’ve got some clear explainers for you, plus breakdowns of what exactly is going on with YFI and YFII in the world of DeFi. Plus, we dive into exactly what choices the Bitcoin community faces as it tries to activate its next major upgrade via soft fork.

This Week’s Crypto News…

Bitcoin Crosses $10k

After months of treading water, the price of Bitcoin surged past $10,000 earlier this week. Although it’s not clear why, recent news has been bullish for crypto, including the Office of the Comptroller of the Currency allowing U.S. banks to custody crypto and the pandemic’s continued dampening of the economy. Some industry analysts also believe that DeFi gains are being redirected toward Bitcoin.

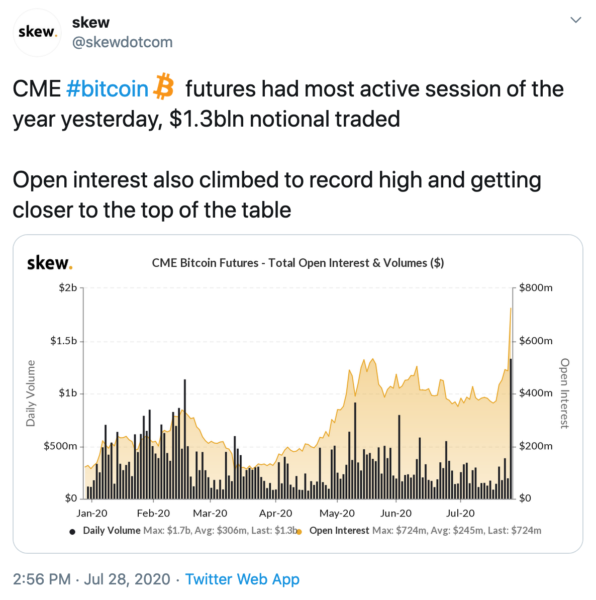

The impact was also felt on derivatives as Bakkt and CME both saw record volumes in their Bitcoin Futures markets.

On a side note, Coinbase Institutional published a report on the first half of 2020 that gives a good overview of the year in crypto so far. It said new people are purchasing Bitcoin and an increasing number of investors are treating it as a store of value. It also highlighted a number of positive metrics in areas as wide-ranging as DeFi to stablecoins to derivatives to mining. For instance, ETH is up 73%, stablecoins have more than doubled, and derivatives have also seen an increase, with BTC options tripling.

An Easy to Understand Ethereum 2.0 Primer

Ethereum 2.0 is coming, and it’s complicated. If you haven’t fully wrapped your head around it yet, CoinDesk published a detailed but accessible report on Ethereum 2.0 that includes everything from the definitions of terms like Serenity, Casper and Shasper to explanations of why, at first, ETH created on Ethereum 2.0 cannot be sent back. It breaks down what will happen in each phase of the transition. For instance, phase 0 launches the beacon chain and proof of stake, phase 1 introduces sharding, phase 2 is for deploying dapps, and phase 3 is the least defined as of yet but will likely include more complex technological features, such as ones that increase privacy. There’s also a deep dive into the economics of Ethereum 2.0, which may lead to the creation of digital assets that will be the tokenized versions of staked ETH and rewards earned by validators.

Also, if you’re wondering what Ethereum 2.0 will look like and want to hear it the way a friend might explain it to you, check out Haseeb Qureshi’s article in Bankless on DeFi in Ethereum 2.0. He writes, “Ethereum 2.0 is going to create a bunch of shards, which will work like loosely connected blockchains. But all the DeFi stuff will end up living on a single shard, since it all wants to coagulate together.” He further adds, “That DeFi shard will be the place where the major DeFi protocols settle—those that benefit from high velocity and being connected to large liquidity pools for liquidations, flash loans, or whatever. Maybe there will be one major financial shard, like London, or two city shards with their own specializations, like New York City and Chicago. I expect if there is a second city shard, it will be for centralized exchange settlement, separated from DeFi and all of its chaos.”

Also, ICYMI, don’t miss the Unchained episode with Camila Russo, founder of The Defiant and author of a new book on Ethereum, “The Infinite Machine,” who spoke about the most pivotal moments in Ethereum’s history.

What’s the Best Way to Upgrade Bitcoin?

Governance in a protocol that takes decentralization as seriously as Bitcoin does is always a tricky subject. With the Taproot soft fork upgrade nearly ready, the Bitcoin community is pondering how best to activate the soft fork. If you’re wondering what the main issues are, a recent Bitmex blog post breaks them down into:

“1. Should the miner threshold signalling period be followed by a flag day activation?

2. Which parts of the activation logic (if any) should be included in Bitcoin Core?

3. Should miner signalling eventually become mandatory?”

For the uninitiated, flag day activation refers to nodes and miners switching to a different code after a certain point in time whereas threshold signalling essentially requires miners and nodes to signal support for a change. Bitmex created a decision tree that goes in order from least amount of centralized decision making to most. For instance, the least amount of centralization would be for there to be no flag day activation and also no activation logic included in Bitcoin Core. The most centralized would be to require a flag day activation, a flag day in the Bitcoin Core software and also for miner signalling at the end of the period.

The report recommends a compromise where Bitcoin Core follows the Bitcoin Improvement Proposal 9 (BIP 9) which includes “a 95% miner threshold activation logic without a flag day and mandatory miner signalling,” which is basically a Goldilocks version.

Why Everyone Keeps Talking about YFI

In the world of DeFi, yield farmers seem to chase high interest rates from protocol to protocol, like lemmings maybe not jumping off cliffs but perhaps parkouring between them. But one new DeFi token stands a bit separate — YFI. As community member Ross Galloway put it in a recent yEarn.Finance messaging board, “Yfi is a mechanism to claim reward and yield-farmed tokens that are earned with the funds in yEarn’s various (and upcoming) products. It may also capture some revenues of upcoming or current products, as decided upon by the community through the governance process. At its core, YFI is the token of a collective yield farm that leverages unique elements of DeFi and Ethereum to capture yield for users of its products.” For those of you who have been following the space for a while, to me, it is similar to a DAO token, if the DAO had survived. And we all know how excited the world had been about the DAO which raised $150 million in 2016 — quite the feat considering how low crypto prices were back then.

On top of that, YFI was distributed almost like Bitcoin — in what the community perceives as a fair distribution, in which no VCs or insiders or even the creator benefited. The token was released via the y.curve.fi pool, in what Ross calls “a continuous farmed offering,” which he describes as “the newest, fairest crowd sale.”

WTH Is YFII

Chinese yield farmers, unhappy about the fact that YFI could only be earned through liquidity mining, forked YFI to create YFII, which has a larger issuance plus a halving mechanism. This may not seem like a big deal, but this spinoff became an example of the differences between the East and West crypto communities, with the Western DeFi community calling it a scam and the Chinese DeFi community hailing it as the next big thing. YFII adoption exploded in China with crypto whales, traditional CeFi businesses, exchanges, mining pools and other entities adding it, while Western projects had a different reaction. Balancer quickly blacklisted the YFII/DAI pool from its front-end interface, which sparked a separate debate about whether Balancer was truly decentralized. The chief analyst at TokenInsight, @minionabct summed it up in this tweet thread: “Communities in the east are not super fuss about risks compared to the west, some experienced ones are willing to ‘gamble’ to chase the high yield, and some are putting a small amount of money just to try it out and experience the excitement on such high yield.”

And speaking of the East, China arrested 109 members allegedly behind the PlusToken project, Bitcoin’s biggest ponzi scheme ever with over $3 billion worth of crypto being scammed.

DeFi Roundup

There’s so much activity in DeFi, we’ll do a quick run through of some of the developments:

- With the explosion in DeFI, the number of contract calls to Ethereum hit an all-time high on July 25, with more than 3.1 million daily contract calls, the majority of them being attributed to DeFi, according to Coin Metrics.

- MakerDAO became the first DeFI protocol to reach $1 billion in total value locked. However, Kyle Samani tweeted that Total Volume Locked or TVL is not a useful metric, at least for lending pools like Compound/Aave, since it subtracts demand from the main metric.

- Meanwhile, Synthetix replaced the Synthetix Foundation with three DAOs, one for protocol upgrades, one to fund public goods in Synthetix, and one to manage and deploy funds to contributors.

- DeFi protocol Aave also went fully decentralized, transferring governance from the Aave core team to AAVE token holders.

- Dharma integrated with Uniswap and enabled support for over 2000 tokens on the Uniswap v2 platform.

- Betting platform Augur launched its version 2, which integrates DeFi features such as IPFS, 0x Mesh, Dai and Uniswap’s v2 oracle network.

- And finally, FTX is launching a DEX called Serum on Solana. According to FTX CEO Sam Bankman-Fried, “Solana can process 10,000 times as much as Ethereum; and it’s 1,000,000 times cheaper.”

TxStreet.com is a very cute transaction visualizer which represents Bitcoin, Ethereum and Bitcoin Cash transactions as little people lining up to ride buses. Whenever a new transaction is broadcast on the network, a person appears to board a bus. They get to board the first bus if the transaction has a high enough fee, otherwise they have to wait their turn.