And $15k BTC!

The election is front and center in everyone’s mind this week — and that even applies to the world of crypto. For the first time, one of the largest non-profit news agencies in America has been using blockchain to verify the accuracy of election results. And a big name in the crypto world made an eye-popping donation to a presidential candidate. Prediction markets also took off during the election season this year, with crypto exchanges seeing massive healthy revenue as a result.

As Bitcoin surpassed $15k for the first time in nearly three years, the Department of Justice seized a billion dollars in BTC tied to the Silk Road dark web market. It’s also looking more and more likely that Ethereum 2.0 could launch this year. And, PayPal’s CEO is revealing more about the company’s plans for crypto in the future, while the BitMEX saga continues with a new civil lawsuit filed as part of ongoing litigation.

On Unchained this week, Meltem Demirors and Lyn Alden discuss Bitcoin’s status since June, amidst a contentious presidential election and a global pandemic. And on Unconfirmed Kristin Smith of the Blockchain Association and HODLpac covers how crypto could be affected by the election under what is likely to be a new presidential administration as well as new members of Congress, including the first one to own Bitcoin.

This Week’s Crypto News…

$1 Billion in Silk Road Bitcoin Seized by the U.S.

On Tuesday, 69,369 bitcoins worth almost $1 billion had been moved out of a wallet associated with the Silk Road marketplace, sparking speculation around who might be behind the activity. The wallet had held, until the move, the fourth-highest balance of bitcoin on any address.

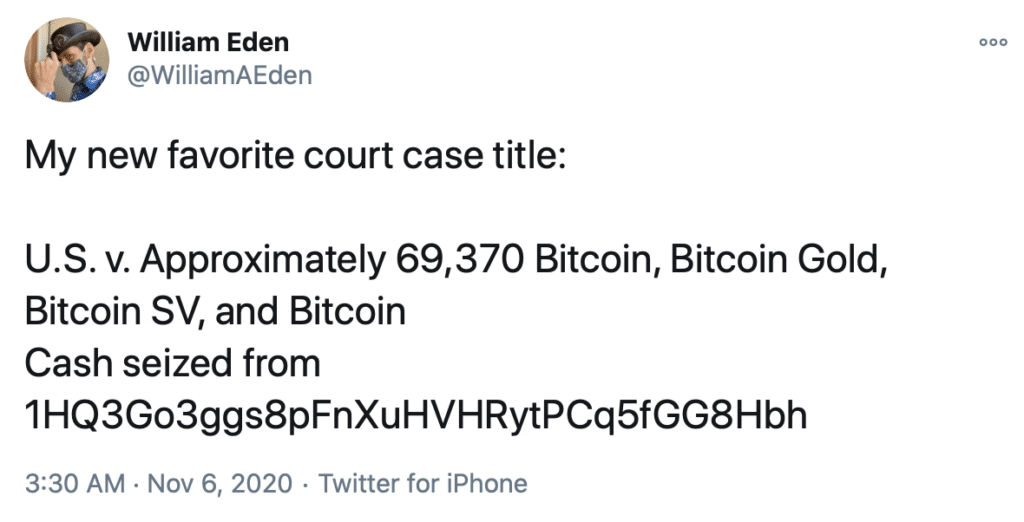

That mystery was solved Thursday, when the Department of Justice announced what they are calling “the largest seizure of cryptocurrency in the history of the [agency].” DOJ has seized and is seeking forfeiture of 69,370 bitcoins, and an equal number of Bitcoin Gold, Bitcoin SV and Bitcoin Cash, that had been been allegedly hacked from Silk Road by a person they refer to as “Individual X,” who has now signed a Consent and Agreement to Forfeiture with the U.S. Attorney’s Office.

U.S. Attorney David Anderson said in a statement that after the prosecution of Silk Road founder Ross Ulbricht in 2015, “a billion-dollar question” remained regarding what had happened to the market’s stash of money. Anderson said, “Today’s forfeiture complaint answers this open question at least in part. $1 billion of these criminal proceeds are now in the United States’ possession.”

Election News Round-Up

While all eyes were on the U.S. presidential election this week, the crypto and blockchain industry participated in its own way.

For the first time in history, the Associated Press has been posting election results on the ethereum and EOS blockchains. The AP is also using the blockchains in its own application programming interface, or API, which enables anyone wanting to view official AP results to verify the accuracy by calling up the blockchain data. The AP voting data has also been published to Everipedia, a blockchain-based version of Wikipedia, built using Chainlink. The AP’s use of these networks is the most extensive use of blockchain technology in elections to date.

Prediction markets also made waves this election, with estimates that crypto exchange FTX would collect as much as $1 million in fees from election betting on its platform. Both FTX and Polymarket offered traders the opportunity to place bets on the winner of the presidential election, and volumes surged in these markets leading up to election day. In other FTX-related election news, founder Sam Bankman-Fried is counted among the top donors to Democratic presidential nominee Joe Biden, having contributed more than $5 million to the former vice president’s campaign.

Finally, as voters across the U.S. prepared to cast ballots, CME Group’s bitcoin futures market hit a record, with overnight trading on election eve reaching 6,700 (the equivalent of 33,500 bitcoin in value). The number of large reportable interest holders throughout October also increased 20%, leading up to election night.

The discussion around blockchains and elections hasn’t stopped there, though. Binance CEO Changpeng Zhao posted on Twitter that a blockchain-based mobile voting app could have prevented the days of vote counting Americans have been enduring. Vitalik Buterin, the creator of Ethereum, chimed in that although “the technical challenges around a secure cryptographic voting system are significant,” the potential is there for such a system to one day be implemented. The main issues here, of course, I think would be identity and security, which I’m pretty sure will not be resolved, as CZ implied they could be, within four years.

Bitcoin Flirts With $15k

On Thursday, Bitcoin surpassed $15,000 for the first time since January 2018, a symbolic milestone for Bitcoin bulls who have been rallying since October. Activity on the Bitcoin blockchain had been steadily increasing since mid-October. In addition to greater network activity, October was a big month for Bitcoin options, with open interest reaching an all-time high.

Ethereum 2.0 Phase 0 Launch Is Imminent

In preparation for the arrival of Ethereum 2.0, the deposit address for ETH2 was released on Wednesday. The address allows future staking participants to prepare their funds for the beacon chain, aka the “Phase 0” launch of Ethereum 2.0. According to a blog post from the Ethereum Foundation, the earliest potential date for ETH2’s genesis is December 1, depending on how soon the required amount of ETH is deposited by staking participants.

PayPal CEO Says Demand Was Almost Triple Expectations

During its Q3 earnings call, PayPal CEO Daniel Schulman discussed the company’s plans around crypto, saying, “this is just the beginning of the opportunities we see as we work hand-in-hand with regulators to accept new forms of digital currencies.”

Although crypto functionality is only available to 10% of PayPal customers, the waiting list demand has been two to three times what the company expected. While some speculate that PayPal is gearing up to support central bank digital currencies, Schulman’s only comment on CBDCs was, “from my perspective and all my conversations [CBDCs] are a matter of when and how they’re done, not if.”

BitMEX Officials Accused of Looting $440 Million From the Exchange

A civil lawsuit is alleging that leadership of HDR Global, which is the parent company of crypto derivatives exchange BitMEX, withdrew $440 million once they learned about investigations and pending charges from U.S. regulators and law enforcement. Last month, DOJ charged the exchange and its executives with violations of the Bank Secrecy Act, arresting one, at the same time as an enforcement action by the Commodities Futures Exchange Commission. The allegations were part of an October 30 court filing as part of a lawsuit that has been ongoing since May, which accuses the co-founders Arthur Hayes, Ben Delo, and Samuel Reed of money laundering and market manipulation. A spokesperson for HDR Global told The Block that the accusations are part of “a series of increasingly spurious claims against us, and others in the cryptocurrency sector. We will deal with this through the normal litigation process and remain entirely confident the courts will see his claims for what they are.”

Coin Center Files Comment on Proposed $250 Travel Rule Threshold

In a comment recently filed to the Federal Reserve board and to the Financial Crimes Enforcement Network, Coin Center argued against a lowered threshold for the travel rule, which would require anti-money laundering checks being applied to transactions as small as $250. The advocacy group’s argument is that what it calls the “imposition of these surveillance obligations” would be intrusive to individual privacy. Additionally, the organization points out that the current travel rule threshold of $3,000 would have been equivalent to $20,000 in 1971, the year that a court case found the Bank Secrecy Act constitutional. However, the proposed $250 threshold would have been equivalent to $40 in 1971. Coin Center also opposes the $250 threshold because, it says, “The constitutionality of today’s application of the Bank Secrecy Act is unknown because we have yet to see a challenge of the regime as it exists.”

The European Central Bank Wants Your Thoughts on a Digital Euro

The ECB is conducting a survey on a potential digital Euro. If you want to participate, you’ll have to go into the show notes to find the link, but be prepared — they want your info first, and then they’ll email you the link to the survey.

At Least It’s Not a Child’s Name

Twitter user Wiliam Eden had this to say about the Silk Road forfeiture case this week: