January 17, 2022 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

USDC supply on Ethereum passed USDT for the first time last week.

-

Ripple will be given access to SEC communications regarding Bill Hinman’s speech in 2018 declaring that Etheruem was not a security.

-

Crypto job listings grew nearly 400% in 2021.

-

Over the weekend, Russia announced a series of raids on REVil, a notorious ransomware group.

-

NFT influencer Cooper Turley was removed from Friends With Benefits DAO after a series of ugly tweets from 2013 went viral.

-

Bitfinex announced that it is closing accounts in Ontario after increased oversight from Canadian regulators.

Today in Crypto Adoption…

-

Walmart recently filed trademarks for metaverse and NFT technology.

-

Customers can now pay for Tesla merch in DOGE.

-

Crocs is looking to launch an NFT line.

- Hulu, a streaming platform, posted a job listing for a manager with crypto expertise.

The $$$ Corner…

- FTX has set aside $2 billion to invest in crypto companies and protocols.

- Lukka, a crypto data firm, raised $110 million in a Series E valuing the company over $1 billion.

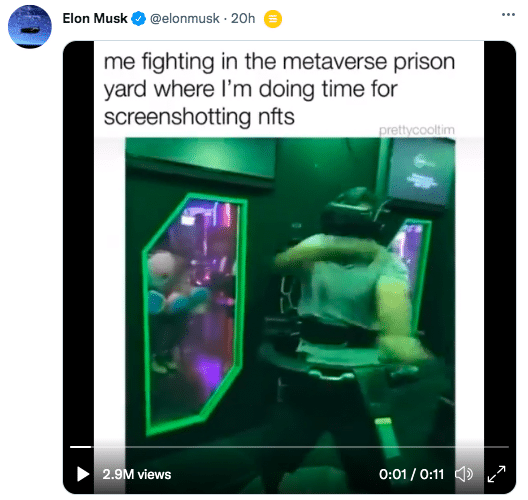

What Do You Meme?

What’s Poppin’?

Rio de Janeiro Likes Crypto, Moody’s Doesn’t

Rio de Janeiro, the 21st largest city by population, intends to convert a percentage of its treasury to crypto, according to a report from O Globo on Friday. “We are going to launch Crypto Rio and invest 1% of the Treasury in cryptocurrency,” said Mayor Eduardo Paes at Rio Innovation Week. O Globo says Mayor Paes planned to establish a working group on the topic as soon as last Friday (however, as of writing time, no decree has been issued).

The Brazilian city with 13.5 million inhabitants is calling the program “Crypto Rio.” In addition to converting 1% of its treasury, the city plans to apply discounts on tax payments made with Bitcoin. “We are studying the possibility of paying taxes with an additional discount if you pay with bitcoins. You take the discount of the single quota of 7% (of the IPTU), it becomes 10% if you pay in bitcoin,” explained Rio de Janeiro’s Finance Secretary Pedro Paulo.

Interestingly, Paes’s comments came during a conversation involving Francis Suarez, the mayor of Miami (a Bitcoiner himself). Last year, Suarez spearheaded a proposal to invest a percentage of Miami’s treasury into BTC. While the proposal passed, no funds have been allocated to crypto yet.

In related news, El Salvador, which invested heavily in Bitcoin during 2021 and recognized the cryptocurrency as legal tender, is coming under fire from Moody’s Investors Service, according to Bloomberg. El Salvador’s Bitcoin trades, which seem to come directly from President Nayib Bukele’s personal device, appear to be down roughly 14% based on the timing of Bukele’s purchase announcements.

Jaime Reusche, an analyst for Moody’s, told Bloomberg that El Salvador’s BTC trading is “quite risky, particularly for a government that has been struggling with liquidity pressures in the past.” Reusche notes that El Salvador’s current Bitcoin holdings of 1,139 BTC does not pose a significant threat to its debt obligations. However, Reusche says increased buying would induce “greater risk” to repayment capacity.

Notably, El Salvador faces an $800 million bond that matures in January 2023. Moody’s already downgraded El Salvador to a rating of Caa1, which judges El Salvador’s bond to be a “very high credit risk.”

Recommended Reads

-

Fais Khan on web3, a16z, and Coinbase:

-

@gonbegood on crypto property rights:

-

The Generalist on Telegram:

On The Pod…

The Chopping Block: Why the Crypto Markets Have Been Down This Week

The Chopping Block is back! Crypto insiders Haseeb Qureshi, Tom Schmidt, and Tarun Chitra chop it up about the latest news in the digital asset industry. Show topics:

-

why crypto assets experienced a drawdown after last week’s FOMC meeting that hinted at accelerated rate hikes

-

which emerging assets Tarun, Haseeb, and Tom envision weathering a bear market

-

which assets could be further hurt by a continued bear market

-

the significance of Paradigm and Sequoia investing in Citadel Securities

-

what aspects of Signal CEO Moxie Marlinspike’s web3 article Haseeb, Tom, and Tarun take umbrage with

-

whether Cryptoland is crypto’s Fyre Festival or whether it’s the metaverse

-

what the heck is going on with the Pudgy Penguins community

-

the lessons from the CFTC’s fine of Polymarket (disclosure: a former sponsor of my shows)

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Feb. 22. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians