December 10, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

Polygon, a side chain working to scale Ethereum, announced the acquisition of Mir protocol, a zero-knowledge proof project, in a deal worth $400 million in Polygon’s native token, $MATIC.

-

Former SushiSwap leader 0xMaki will not be returning to the DEX in light of former CTO Joseph Delong’s departure.

-

Crypto prices fell on the news of Evergrande’s default in China.

-

FreeRossDAO purchased an NFT collection from the incarcerated Silk Road co-founder Ross Ulbricht for 1,446 ETH.

-

MicroStrategy bought an additional $82.4 million in BTC for its balance sheet.

-

A new pilot on WhatsApp, the Meta-owned messaging app, allows users in the US to send and receive crypto within a chat.

-

Strike is launching a dollar-cost-average product in the US.

-

Braintrust, a web3 talent project, raised $100 million in a private token sale.

-

Ubisoft’s YouTube trailer for its recent NFT announcement received a 96% dislike rating over 22,000+ votes and was delisted.

-

Microsoft and Warner Bros participated in a $27 million Series B for Palm NFT Studio.

-

Messari released a governance aggregator dubbed “Messari Governor” that creates a framework for DAOs to function.

-

Ledger revealed a new crypto debit card.

- CryptoPunk #4156 sold for 2,500 ETH (~$10.2 million).

What Do You Meme?

What’s Poppin’?

Coinbase Excludes US Citizens From High-Yield Stablecoin Program

Coinbase is attempting to make DeFi accessible (and cheap) with its new product that allows users to earn a yield on Dai, a stablecoin that tracks the price of a US dollar.

According to Coinbase’s blog post announcing the program, users will directly interact with DeFi protocols from their Coinbase accounts. Crucially, Coinbase says it will not charge network fees for the service.

By opting into this DeFi yield program, Dai is deposited into Compound Finance, a DeFi lending protocol. That Dai will then start earning interest depending on Compound’s rates, which, for example, fluctuated between 2.8%-5.4% during October. This amounts to a far higher yield on deposits than a standard savings account.

Coinbase says that deposited Dai will be available to users at all times, without network fees. Notably, the program is going live in 70 countries, including the United Kingdom, Germany, and Spain — but not the United States.

The move comes after Coinbase failed to launch a similar sounding yield-earning project in the US, dubbed Lend. The project was shut down after the SEC threatened to sueCoinbase Lend was launched. At around the same time, Coinbase’s CEO took to Twitter to profess his frustration with regulators, calling the SEC’s behavior, in particular, “sketchy.”

Recommended Reads

- Visa on consumer attitude and usage of crypto assets:

- Fidelity Digital Assets on digital assets and institutional portfolios:

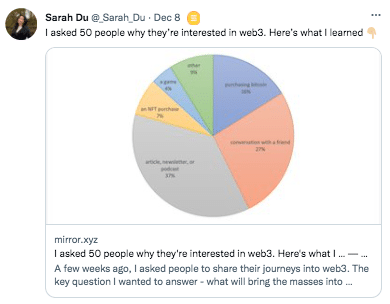

- Bessemer’s Sarah Du on why people are interested in web3:

On The Pod…

3 Things SushiSwap Needs to Get in Order, According to Arca

Jeff Dorman, the chief investment officer at Arca, discusses the recent events surrounding SushiSwap, including CTO Joseph Delong’s departure this week, Arca’s proposal to create a hierarchical management structure for SushiSwap, and why Jeff is still excited about Arca’s investment in SushiSwap. Show topics:

-

what SushiSwap is and how it has performed since its inception

-

how Jeff views SushiSwap’s performance from an investor’s perspective

-

how the departure of 0xMaki affected SushiSwap

-

what Jeff thinks about the decentralization versus centralization

-

why Jeff thinks SushiSwap is in a fantastic position in which to receive investment

-

what happened with the controversy around Joseph Delong leading to his resignation this week

-

what Jeff thinks about how Joseph handled his departure

-

what three factors SushiSwap needs to figure out in order to function

-

why SushiSwap could benefit from creating a legal entity

-

why Jeff is in favor of hierarchical governance structures versus flat governance structures

-

how SushiSwap could become a trendsetter for DAOs in general

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Feb. 22. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians