June 17, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

BitDAO, a decentralized autonomous organization, has been formed; several investors, including Peter Thiel and Alan Howard, are backing its $230M fundraise

-

Fox is investing $100M into its NFT studio, Blockchain Creative Labs

-

Morgan Stanley is eyeing a fourth Bitcoin fund

-

The SEC has delayed its VanEck bitcoin ETF decision and will seek additional comments

-

DeFi lender Goldfinch announced a raise of $11M led by a16z

-

Big Time Studios plans to sell NFTs on Binance

-

Alchemix experienced a “reverse rug pull,” effectively sending a lucky group of customers free money due to a bug

-

According to the Federal Reserve’s FOMC statement, “Inflation has risen, largely reflecting transitory factors”

-

The roster for Congress’s crypto working group is set to feature members of the Blockchain Caucus and Fintech Task Force

-

Sygnum, a Swiss Digital Bank, is offering Ethereum 2.0 staking to clients (as reported by CoinDesk)

- South Korean crypto exchanges have stopped trading or issued warnings regarding certain coins considered too risky

- Scammers are sending out fake Ledger devices to customers exposed in a recent data breach

What Do You Meme?

What’s Poppin’?

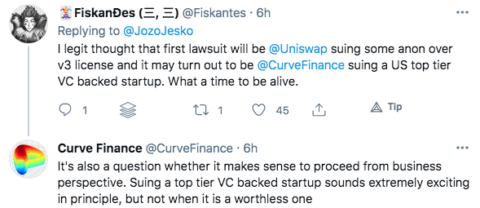

Welcome to the metaverse: a recent proposal on Curve’s governance forum calls for the DeFi protocol to enforce its intellectual property rights in court.

Curve is a DeFi project built on Ethereum that specializes in stablecoin trading. Through CRV, Curve’s governance token, changes to the protocol can be proposed and voted upon by token holders.

hydrosam, the author of the proposal, believes that Curve’s DAO should protect its IP on behalf of its stakeholders, just as centralized exchanges would protect IP on behalf of a shareholder.

“Curve has proven incredibly popular, with over $10B deposited, hundreds of millions in daily volume, and around $1M/week in earnings to veCRV holders. This places it among the top of all exchanges in crypto today, even rivaling publicly-traded CEX’s… Those CEX’s protect their IP on behalf of their shareholders and there is no reason why Curve, just by virtue of its DAO organization, should not protect itself for the benefit of veCRV holders too.”

Written yesterday, the proposal takes aim at Saddle Finance (a competing AMM), which, as the proposal notes, “has been accused of wholesale copying of Curve code.”

For example, back in January, Curve told Crypto Briefing that a Quanstamp audit found Saddle Finance’s implementation of its StableSwap function to be “exactly the same algorithm” seen in Curve’s codebase.

The proposal argues that Curve’s governance forum should “ review any proposals from law firms, make them public, and put them up to a DAO vote. Any proposed settlement should also be subject to DAO vote.”

At the moment, 75% of members of the Governance forum agree with the proposal, though the voter turnout is minute:

It appears that DAO IP and ownership is a topic to keep an eye on. DeFi is, by definition, decentralized and open-source. Projects and tokens can be launched quite easily by copying and pasting code with a few new modifications. Perhaps the most well-known example of this is SushiSwap, which became the first major DeFi fork by launching a project based on Uniswap — with the addition of a token and governance system (this is called Vampire Mining).

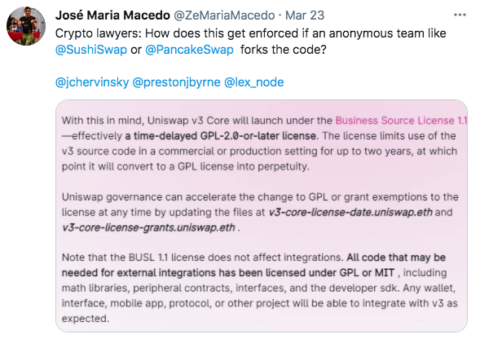

Back in March, Uniswap’s v3, in a similar vein to the Curve proposal, launched with a “business source license” that delays the commercial use of its code for up to two years.

The question for Uniswap now becomes, as Jose Macedo, partner at Delphi Digital, asked on Twitter: how do you enforce a license if an anonymous and decentralized team forks the code?

For Curve, the question is slightly different, as it would be facing Saddle Finance, which is backed by Polychain and Electric Capital, amongst others.

Recommended Reads

- Goldfinch on its $11M raise and purpose, which is to bring loans without collateral to DeFi:

- Financial Times wrote a rather scathing article on MicroStrategy and Bitcoin:

- Andreessen Horowitz recently launched its media property, which features quite a few good crypto pieces:

On The Pod…

-

what I think about the relationship between psychedelics and crypto

-

the most entertaining guest I’ve interviewed on Unchained

-

why Coinbase founders may have a more impactful future on crypto than Ethereum founders

-

which show has been the most impactful

-

why I am a “nocoiner”

-

where I believe DAOs fit into the future of crypto

-

who my favorite guests have been over the years

-

what I am most fearful and most hopeful about in the crypto space

-

why I think user-friendly products are so important moving forward

-

which DeFi projects I find the most interesting

-

what sort of expenses go into producing Unchained

-

which topics I would like to cover in the future

-

the most surprising answers I have received in an interview (feat. CZ and Vitalik)

-

what three cryptos I think will be most important three years from now

-

if I think I have interviewed Satoshi 🙂

-

my advice for anyone looking to change careers and go crypto

-

who has been the hardest person to book on Unchained

-

what crypto trend has surprised me the most in the past five years

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Nov. 2nd. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians