January 25, 2022 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

The Biden administration intends to release an executive order about crypto in February.

-

JPMorgan Chase shut down the account of Hayden Adams, the founder of Uniswap.

-

A bug on OpenSea led to one Bored Ape Yacht Club being soldfor $1,700 in Ethereum (the current price floor for a Bored Ape NFT is 80+ ETH, or more than $200,000).

-

Coinbase and Robinhood briefly traded at an all-time low on Monday.

-

Digital asset investment products saw an inflow of $14 million last week.

-

Polymarket, a crypto predictions market that recently settled with the CFTC (and disclosure: a former sponsor), relaunched its platform with a US geoblock in place.

-

Congressman Patrick McHenry wrote a letter saying regulators are overstepping their bounds when it comes to digital assets.

-

Coinbase hired a former SEC official as its senior public policy manager; the exchange also launched a free tax center.

- Various crypto YouTube channels were hacked yesterday by an altcoin ad.

Today in Crypto Adoption…

-

Harbor Custom Adoption, a US-based real estate development company, will accept BTC for its real estate properties.

- Bank of America thinks a US CBDC could help preserve the dollar’s supremacy.

The $$$ Corner…

-

Blockchain Founders Fund raised $75 million for a new web3-based fund.

What Do You Meme?

What’s Poppin’?

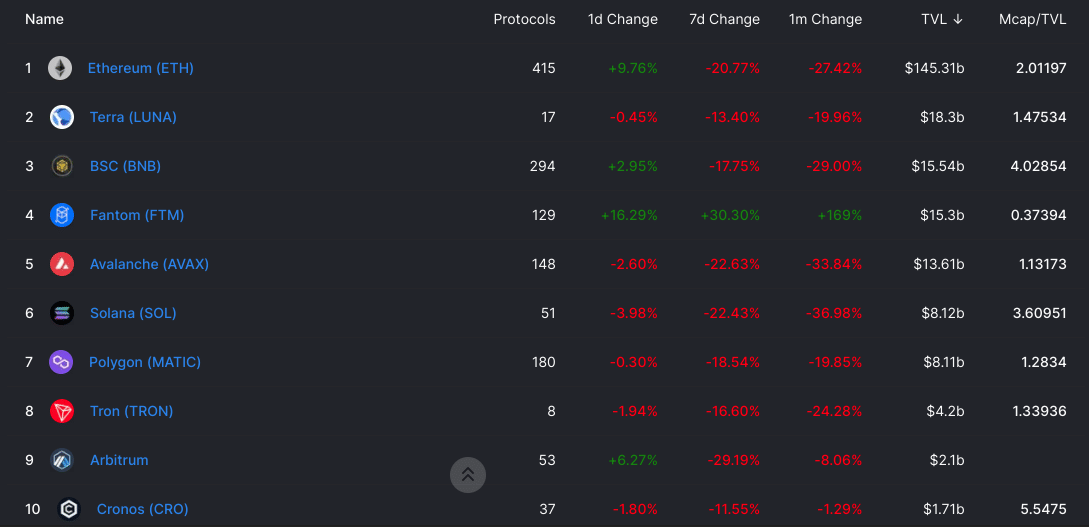

Fantom’s TVL Is Coming for BSC

According to DeFi Llama, approximately $246 billion worth of crypto assets are locked into DeFi protocols. Much like the entire crypto market, total value locked (TVL), the amount in tokens secured by a specific chain or application, has taken a hit in recent weeks and currently sits about 23% off the late-December all-time high of $321 billion.

Fantom, a smart contract blockchain (or layer 1), has bucked that trend. During a month-long period in which Avalanche and Solana experienced a 30%+ decline in TVL and Ethereum, Terra, and Binance Smart Chain lost 20%+ in TVL, Fantom’s TVL increased a whopping 169%. At $15.21 billion, Fantom is currently jockeying with Binance Smart Chain ($15.5 billion) for third-largest chain by TVL.

Value locked into Fantom is spread across 129 applications. However, only 26 protocols hold more than $100 million in assets. Just under half of Fantom’s TVL (47%) is deposited into Multichain, and another $4 billion+ is locked into OxDAO.

Data from CoinMarketCap shows that FTM, Fantom’s native token, is up 5.95% over the past 30 days, coinciding with its exploding in TVL. However, the token is down over 24% in the past seven days (as of 6:30 pm ET on Monday), even though TVL is up 30%. This is notable, as it appears Fantom’s token price is lagging behind its market cap. For example, every other top 5 chain by TVL trades at a multiple of its TVL (e.g., Ethereum has a $290 million market cap with $145 million in TVL). Fantom, however, is only trading at just over one-third of its TVL (possibly because of the bearish sentiment in the crypto market).

Recommended Reads

-

Delphi Digital on the last week in crypto:

-

@Laine_sa_ on Solana liquidations:

-

Messari’s Mason Nystrom on getting a job in web3:

On The Pod…

SyndicateDAO Is Launching Web3 Investment Clubs. Could They Disrupt VCs?

Will Papper and Ian Lee, the two co-founders of Syndicate, join Unchained to announce the release of Syndicate’s new product: Web3 Investment Clubs, an innovation they believe could end up disrupting the web2 investment world, along with the entire venture capital industry. For example, with Web3 Investment Clubs, users will be able to turn an Ethereum wallet address into an investing DAO with just a few clicks, transfer funds without going through banks, and manage a cap-table directly on-chain. Show topics:

-

what differentiates a Web3 Investment Club club from a normal investment club

-

what on-chain tools Syndicate has built for Web3 Investment Clubs

-

how Web3 Investment Clubs work within existing regulations

-

how Ian and Will met and what inspired them to create Syndicate

-

whether Syndicate plans to decentralize

-

why Will and Ian believe investment DAOs will disrupt the venture capital industry

-

why venture capital firms invested in Syndicate, a company built to disrupt them

-

what Will learned from building Adventure Gold (AGLD), the governance token for Loot

-

what plans Syndicate has for 2022

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Feb. 22. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians