January 6, 2022 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

Bitcoin mining pool hashrate crashed after Kazakhstan’s government cut off internet access.

-

OpenSea is in talks to buy Dharma Labs, a digital wallet.

-

Airbnb CEO Brian Chesky said the most asked for product for 2022 was crypto payment integration.

-

Quentin Tarantino plans to sell Pulp Fiction NFTs despite a lawsuit from Miramax, which produced the film.

-

The sports and e-commerce firm Fanatics acquired Topps trading cards for $500 million and has plans to use Topps’s exclusive rights to MLB digital artwork to build out its NFT arm.

-

CryptoSlam, an NFT data platform, raised $9 million in a seed round backed by Mark Cuban and Animoca.

-

Crypto.com (disclosure: a sponsor) had two ads blockedby a UK advertising regulator.

-

Livepeer, a DeFi video streaming project, raised $20 million in a Series B.

- Brave, the crypto browser powered by the BAT token (and, disclosure, a previous sponsor), just hit 50 million monthly active users.

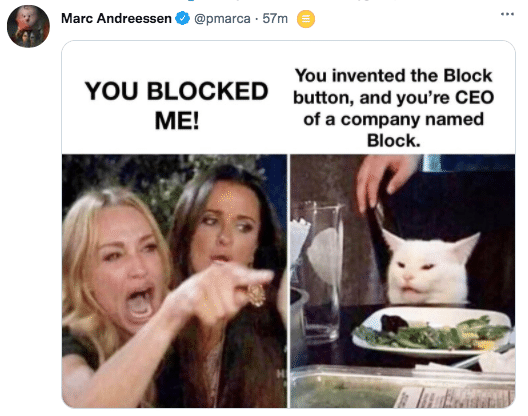

What Do You Meme?

What’s Poppin’?

Permissioned DeFi Starts With a Whitelist

Yesterday marked the launch of Aave Arc, a permissioned version of Aave, one of the most popular borrowing/lending protocols in the crypto space. The launch brings 30 institutions into the DeFi space, such as CoinShares, Celsius, and Wintermute.

Each Aave Arc participant must be “whitelisted” by Fireblocks, a New York-based crypto custodian, which will require entities to undergo rigorous customer identification processes. Fireblocks was approved by the community in November and is the only entity that can whitelist new entities for entry into Aave Arc. (SEBA, a Swiss Bank, recently proposed itself for a whitelist role via Aave’s governance forum, though no vote has taken place as of yet.) Fireblocks will be implementing know-your-customer procedures in accordance with FATF guidelines.

“From hedge funds to banks, regulated DeFi tooling could unleash a wave of new products and services such as flash-loans and high-yield deposit accounts,” said Michael Shaulov, CEO of Fireblocks. “Together with Aave Arc, our technologies can supercharge financial innovation around the world and exponentially grow the size of the market overnight.”

The new platform will use a separate deployment of Aave v2 that will restrict access to only whitelisted entities. In essence, Aave Arc allows institutional players to join the crypto fray, where yields range from .01%-8.66% APY on digital asset deposits – a far cry from the yield found in the traditional world.

“DeFi represents a powerful wave of financial innovation including transparency, liquidity, and programmability–and it’s been inaccessible to traditional financial institutions for far too long,” said Stani Kulechov, Founder & CEO of Aave. “The launch of Aave Arc allows these institutions to participate in DeFi in a compliant way for the very first time.”

The launch of Aave Arc comes roughly six months after it was first announced by Kulechov. Aave Arc is not the first major rebrand of a DeFi protocol for institutions. Compound, the tenth-largest DeFi protocol by total value locked, launched an institutional company in June of 2021, dubbed Compound Treasury, allowing neobanks and fintech firms to earn approximately 4% on USDC deposits.

Recommended Reads

- Variant Fund’s Cooper Turley and Pantera Capital’s Lauren Stephanian on dropping a token: https://mirror.xyz/lstephanian.eth/kB9Jz_5joqbY0ePO8rU1NNDKhiqvzU6OWyYsbSA-Kcc

- Electric Capital on blockchain development: https://medium.com/electric-capital/electric-capital-developer-report-2021-f37874efea6d

- Multicoin’s Kyle Samani on predicting the future: https://twitter.com/KyleSamani/status/1478429674011250693

On The Pod…

Crypto 2022 Outlook: Where Will the Markets Go This Year? Plus DeFi and NFTs

Larry Cermak, VP of research at The Block, and Igor Igamberdiev, director of research and data at The Block, recap the most significant trends of 2021 (BTC mining, L1s, NFTs, DeFi, venture funding) and discuss what might happen in 2022. Show topics:

-

why 2021 was so significant for the crypto industry

-

why the crypto markets didn’t see a blow-off top at the end of the calendar year the way they typically do about a year after a Bitcoin halving

-

what Larry thinks about whether the crypto market is in a supercycle

-

how the state of BTC and ETH mining changed in the past year

-

why Igor thinks multichain technology was key to a record-breaking year for venture capital entering the crypto space in 2021

-

how the layer 1 (L1) ecosystem wars played out in 2021 and what it could look like in 2022

-

what Larry and Igor think of Ethereum layer 2s (L2s)

-

how Ethereum’s shift to 2.0 could affect the L1 race

-

what Larry thinks about DeFi tokens going into 2022

-

how DeFi trends, like decentralized exchange volume and lending, played out in 2021

-

why Igor thinks KYC-DeFi (know-your-customer decentralized finance) is inevitable

-

what Larry thinks about NFTs going in 2022 and why he thinks PFPs are dead

-

Larry and Igor’s outlook on the metaverse going into the new year

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Feb. 22. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians