A rough week in crypto.

DeFi protocol bZx suffered two attacks that enabled the attacker(s) to make off with almost $1 million total. How did that happen? We dive into the details on this week’s episode of Unconfirmed with Lev Livnev, the programmer who discovered that the first attack had occurred.

Also, this week we continue the series of essays on Unchained with a thought-provoking piece by Santiago Siri on how identity and governance change in the age of cryptography. I highly recommend you give it a listen!

Meanwhile, there was a lot of crypto news, not a lot of it great for the industry: aside from the bZx hacks, there were vulnerabilities found, crimes alleged, and a big exchange insolvency. But for those of you who are fans of Matt Levine, DeFi also made an appearance in his Bloomberg column, Money Stuff.

This Week’s Crypto News…

A Close Look at Coinbase’s Business

Michael Del Castillo, my kinda sorta colleague at Forbes — he and I never overlapped, but I wish we had! — published a great pair of articles this week, one a feature on Coinbase, which dived deeply into the company’s business. Michael and his co-author, William Baldwin estimate that Coinbase has been “solidly in the black for several years,” and is on track to top $800 million in revenue this year. Plus, they note that the firm has 35 million accounts and “presides over” $21 billion in assets. In a related news piece, Michael reports that Visa has granted Coinbase the power to issue cryptocurrency debit cards, with bitcoin, ether, XRP, Litecoin, Bitcoin Cash, BAT, REP, ZRX and Stellar Lumens as the cryptocurrencies available on the card. The card will launch later this year in 29 countries, but the US will not be one of them. Btw, the feature story also says that, according to Coinbase, it handled $80 billion of transactions last year. Michael and William say that Binance’s daily volume annualizes to $1 trillion. So, speaking of Binance …

Binance Announces New Crypto Exchange Cloud Operation

Bloomberg reports that Binance is launching a new service: lending its technology and liquidity to those wanting to launch their own exchanges. CEO Changpeng Zhao predicted to Bloomberg that Binance Cloud will become the company’s biggest source of revenue in five years. Binance already has one fiat exchange which it will be ready to announce in the coming weeks, plus has confirmed four other clients. And Binance will offer these clients access to the order books of existing trading pairs on Binance.

FCoin Insolvent Due to $130 Million Shortage in Its Crypto Asset Reserve

FCoin, a crypto exchange that became known for its controversial “trans-fee mining” model revealed that it was insolvent due to errors in its internal system. CEO Zhang Jian said in a post that the exchange had been crediting users with more in rewards than it should have. The exchange had issued an exchange token called FT and when users paid transaction fees in bitcoin or ether, the platform would reimburse the user 100% of the value in FTs. Plus, FCoin distributed 80% of the transaction fees in bitcoin to users who held FTs throughout the day. According to Zhang, the system began giving away more in mining rewards than users should have earned starting in mid-2018 but didn’t realize it until a 2019 audit.

DOJ Indictment Calls Operating a Bitcoin Mixer or Tumbler a Crime

Larry Harmon of Akron, Ohio — here’s where I would normally do a shout-out to Akron, as this is the area I’m from, but it somehow feels inappropriate to do with this story — was arrested for operating Helix, which the Department of Justice alleges laundered over $300 million by moving more then 350,000 bitcoin, with the largest amount coming from dark net markets. It also alleges that Helix partnered with Darknet market Alphbay, which was seized by law enforcement in July 2017. His brother told CoinDesk that Helix, which also closed in 2017, did not directly partner with Alphbay and that the market recommended his mixer without input or permission from Larry.

MIT Researchers Reveal Flaws in Blockchain-Based Voatz Voting App

MIT researchers Michael A Specter, James Koppel and Daniel J. Weitzner found that it is possible to monitor and even change or block votes in the blockchain-based voting app Voatz, V-O-A-T-Z. They also say that the attacks could even taint the paper trail created by the app, which would, of course, make it impossible to audit.

DeFi and tBTC Make It Into Money Stuff!

Yes, the crypto people who geek out about Matt Levine’s columns on Bloomberg were excited when he wrote about an announced DeFi project called tBTC, which is a “trustless bridge” between Bitcoin and Ethereum. The tBTC website says, “1) deposit BTC, 2) mint tBTC and 3) lend and earn interest in your BTC.” Project lead Matt Luongo calls this an improvement on other Ethereum-based tokens pegged to Bitcoin such as wrapped BTC, which played a role in the first bZx attack and is a synthetic. He told The Block, “Bitcoiners want to be able to get back to the Bitcoin chain,” he said. “For the asset to be considered valid and theirs, they have to be able to redeem trustlessly and a synthetic doesn’t do that.” As Matt Levine wrote in his column, “if you want to live in Ethereum but own Bitcoins, you can. It’s like a stablecoin, which I think of as a way to live in Ethereum but own dollars. This is just a stablecoin pegged to Bitcoin. Why not.”

TakerDAO tells MakerDAO ‘Expect Us’

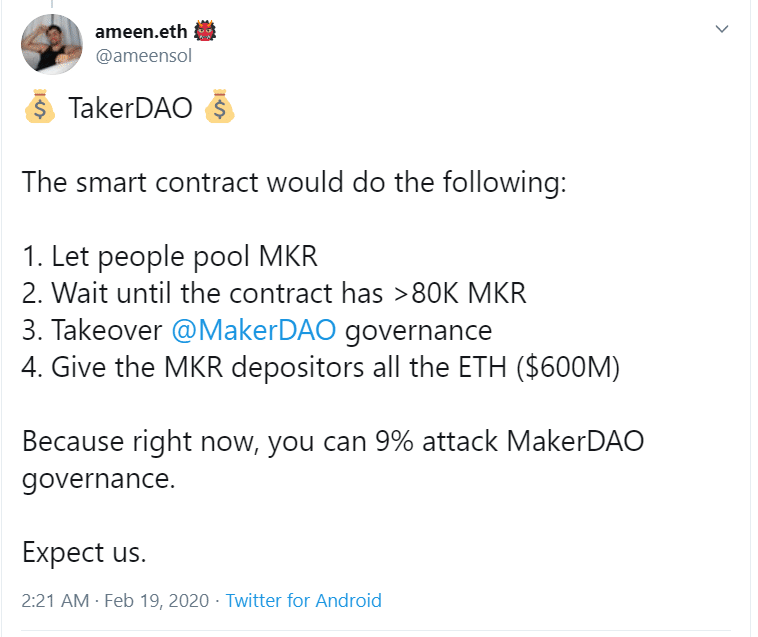

Leave it to Ameen Soleimani of Spankchain and MolochDAO to announce his plans to code up a smart contract called TakerDAO.

Before I tell you all what Ameen’s plans are regarding TakerDAO let me just mention a blog post by Coinmonks from December called How to Turn $20 Million Into $340 Million in 15 Seconds, which stated that due to the amount of MKR needed to take control of MakerDAO governance, “the naive cost of doing just about whatever you want to the Maker contracts is about 80,000 MKR.” (Also, let me note that, for just this reason, people have been watching the amount of MKR in Uniswap rise precipitously in the past couple weeks.)

With that context, here is Ameen’s description of the TakerDAO smart contract he plans to launch unless MakerDAO makes some changes.