October 19, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

The crypto industry market cap broke $2.6 trillion — a new all-time high.

-

The ProShares bitcoin futures ETF began trading this morning.

-

Facebook is hiring 10,000 new employees to build its metaverse.

-

Crypto investment funds saw $80 million in inflows for the week ending October 15th.

-

Fitch Ratings warns that stablecoins could affect securities markets.

-

In its quarterly burn, Binance destroyed nearly $640 million of BNB.

-

Société Générale (SocGen) is looking to purchase a cryptocurrency custodian.

-

New York Attorney General Letitia James directed two unregistered crypto lending platforms, most likely Nexo (disclosure: a former sponsor of my show) and Celsius, to immediately cease operations in New York.

-

Interactive Brokers now allows Registered Financial Advisors in the US to trade crypto on behalf of their clients.

-

Bloomberg ETF analyst Eric Balchunas thinks Valkyrie’s bitcoin futures ETF could launch this week.

- DraftKings, a sports betting company, plans to become a full validator on Polygon.

What Do You Meme?

Holiday season is upon us #bitcoin #memepool pic.twitter.com/Bd7qlIFy2X

— Ḿ̷̯a̵̡̽ṱ̵̃t̵̡̄y̸̼͠ ̵͚͋G̶̖͘ 58k (@itsyaboymattyg) October 18, 2021

What’s Poppin’?

dYdX, a derivatives-based cryptocurrency trading platform, is poppin’.

Fresh off an airdrop on September 8th, the protocol, which combines layer 2 low fees and access to perpetual futures on the blockchain, has set a blistering pace in terms of volume. For example, just last week, the DEX hit $100 billion in cumulative volume.

dYdX cumulative volume has now passed $100B! 🚀🎉

Shout out to all the hedgies🦔 who made this possible

Aug Cumulative Volume: $3.4B

September Cumulative Volume: $17.8B

October Cumulative Volume: $73.9B

Next stop: $1 TRILLION 📈 pic.twitter.com/9yVObK98oa— dYdX (@dYdX) October 13, 2021

Forbes was the first to pick up on dYdX’s surge in popularity, pointing out that the exchange saw over 3x more volume than Coinbase from September 27th and 28th.

The perpetual exchange is also crushing decentralized exchange competitors. Data from CoinGecko shows that dYdX has done $88.89 billion in volume over the past 30 days. In comparison, volume on all Ethereum DEX’s, including Uniswap, SushiSwap, and 0x, combined to hit only $70 billion during the same period, according to Dune Analytics.

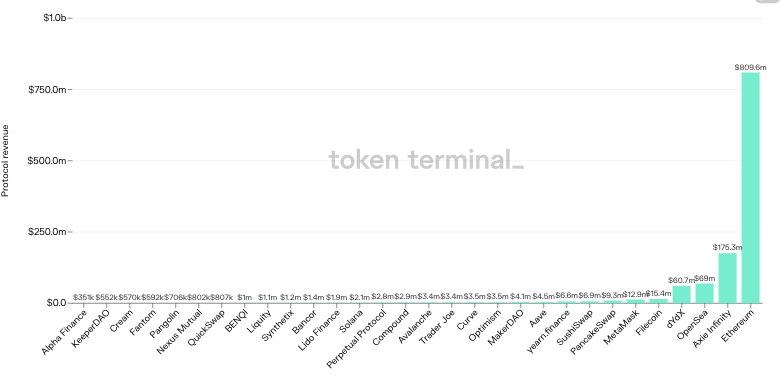

The swell in volume has helped dYdX pull in over $60 million in revenue — good for fifth place amongst all protocols listed on Token Terminal.

Notably, dYdX’s success comes despite US users being geoblockedfrom the platform (and airdrop).

Recommended Reads

- The Generalist on the future of NFTs:

- Dove Metrics on Q3 crypto fundraising:

- Representative Tom Emmer on what he would do in SEC Chair Gary Gensler’s shoes:

On The Pod…

Is the Metaverse Already Here? Two Experts Disagree

Andrew Steinwold, managing partner at Sfermion, and John Egan, CEO at L’Atelier BNP Paribas, discuss NFTs and debate the characteristics of the metaverse. Show highlights:

- their backgrounds and how they got into NFTs

- how they each define the metaverse

- what NFTs have to do with the metaverse

- how John and Andrew’s depiction of the metaverse differs

- what John thinks about Facebook’s entrance into the metaverse

- whether Second Life is a metaverse game

- how blockchain technology allows for an open metaverse (and why Web2 is “communist”)

- what NFTs currently unlock for the metaverse

- whether the metaverse will necessarily have to be experienced through augmented reality

- whether there will be multiple metaverses across different blockchain platforms

- why John thinks NFT maxis and crypto maxis are destined to clash

- how the metaverse is changing how people generate income

- how to make the metaverse more accessible

- whether regulators will force the metaverse to be siloed

- how the metaverse will handle jurisdictional disputes

- what happens when someone’s Web3 avatar/identity is stolen in the metaverse

- what John and Andrew predict will happen in the metaverse over the next 6-12 months.

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians