January 31, 2022 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

A US law that would enforce KYC rules on unhosted crypto wallets might be under consideration (again).

-

Fidelity is looking to launch metaverse and crypto ETFs.

-

A bug on Qubit Finance led to a hacker getting away with $80 million.

-

Visa crypto credit card users made $2.5 billion in payments during the first fiscal quarter of 2022.

-

GMI PAC is a political committee that will back crypto-friendly congressional candidates in the 2022 midterm elections.

-

El Salvador’s crypto wallet Chivo keeps breaking, according to The Block.

-

The price of LUNA is down in the aftermath of Wonderland’s drama.

Today in Crypto Adoption…

-

A senator in Arizona introduced a bill to make BTC legal tender in the state.

-

Texas Governor Greg Abbott is inviting BTC miners into the state to stabilize the electric grid.

The $$$ Corner…

-

Astar Network, a Polkadot parachain, raised $22 million.

-

Crypto exchange Apifiny is set to go public via a SPAC in a $530 million deal.

- Hedge fund Brevan Howard has set aside $250 million to invest in the crypto space.

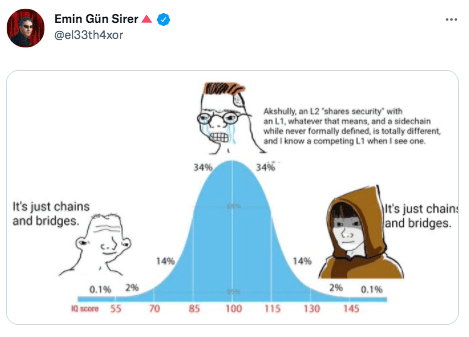

What Do You Meme?

What’s Poppin’?

Crypto Market Crash? NFTs Don’t Care

Crypto began 2022 a $2.2 trillion asset class, according to data from CoinMarketCap. Thirty days later, the crypto markets are at $1.7 trillion – down 22% to begin 2022. Year-to-date, Bitcoin is down 18%, Ethereum has sunk 29%, Solana and LUNA have plunged 45%, and Crypto.com is down 24.2%. Out of the top 20 non-stablecoins, the best performing token (LINK) is down 9% over the past 30 days.

However, non-fungible tokens have been on fire. Previously, the all-time high for NFT volume was $3.31 billion in August. This month, NFT volume across all NFT marketplaces has doubled August’s ATH at $6.67 billion, data from The Block shows.

The NFT volume boost was primarily generated from three NFT marketplaces. OpenSea accounted for just over 60% of NFT volume in January. LooksRare, a new NFT platform that launched on January 10th, exploded onto the scene, accumulating over $2.15 billion in volume in just a few weeks. MagicEden, a Solana-based NFT marketplace, also contributed substantial volume, facilitating $305 million in January.

The explosive growth in NFT volume came during a month where NFT adoption was rampant.

Based on news and rumors from January, it appears that NFTs are going to play a significant role in social media going forward. Twitter integrated NFTs into its Twitter Blue service this month. Reddit began testing a feature for NFT profile pictures. YouTube announced it is considering ways to combine NFT minting with creator capitalization. Meta is reportedly exploring ways to bring NFTs to Facebook and Instagram.

In addition, NFTs have been institutionalized. For example, Bud Light dropped an NFT collection. YouTube’s head of gaming leftthe streaming service to join Polygon Studios as CEO. The Ultimate Fighting Championship is getting into NFTs through a partnership with Dapper Labs. Candy Digital launched an NFT marketplace for officially licensed Major League Baseball products. Gap, the apparel retailer, rolled out an NFT collection on Tezos.

And, of course, celebrities are entering the space at a rapid pace – as evidenced by Justin Bieber’s $1.3 million Bored Ape Yacht Club purchase this weekend (joining celebs such as Jimmy Fallon, Paris Hilton, and Gwyneth Paltrow in the BAYC community).

In a thread about crypto bubbles on Twitter, Blockworks co-founder Michael Ippolito explained the rise of NFTs. “NFTs were the ICOs of this cycle: sky-high hype, euphoria, and a small number of good projects floating on a sea of garbage,” wrote Michael.

“But NFTs did something crypto has never done before: they crossed the chasm into pop culture. For the first time in crypto’s history, NFTs captured the imagination [of] non-libertarian finance nerds. BAYC and Punks onboarded celebrities from Jay Z, to Steph Curry, to Serena Williams, to J Biebs,” he added, before asking: “The question is, where do we go from here?”

Recommended Reads

-

Yearn Finance founder Andre Cronje on his philosophy for building DeFi protocols:

-

@0xemporer on a few issues that DeFi needs to solve before going mainstream:

-

CoinShares’s Meltem Demirors fact-checked a recent letter to cryptominers penned by a group of Congress members.

On The Pod…

Can a Pro-Bitcoin Platform Help in a Congressional Race? Aarika Rhodes Says Yes (Bonus content: read a summary of my conversation with Aarika on Medium)

Aarika Rhodes is running for Congress in Rep. Brad Sherman’s District – and she is pro-Bitcoin. On Unchained, she discusses her views on BTC, financial education, and why anyone who holds crypto should vote for her instead of the notoriously anti-crypto Sherman, famous for his rant about Mongoosecoin. Show topics:

-

why Aarika, a teacher by profession, decided to run for Congress

-

why Aarika believes that being pro-Bitcoin will put her on the right side of history

-

whether she is only pro-Bitcoin or whether she is for other cryptocurrencies too

-

how Aarika’s outlook on crypto differs from her opponent, Congressman Brad Sherman

-

why Aarika believes that being pro-Bitcoin is the same thing as being pro-innovation

-

how accepting Bitcoin for her campaign works on the back-end

-

why she thinks personal finance should be taught in schools

-

why Aarika thinks Bitcoin will have a significant impact on midterms

-

why she believes Bitcoin is a bipartisan issue

-

what Aarika thinks about Bitcoin’s energy usage

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Feb. 22. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians