June 16, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

The US House of Representatives Fintech Task Force held a hearing yesterday about CBDCs

-

Within five years, North American hedge funds expect to hold 10.6% of assets in crypto

-

Bitwise raised $70M in Series B funding, led by Henry Kravis, Stanley Druckenmiller, and David McCormick

-

House Democrats are organizing a working group focused on cryptocurrencies

-

dYdX closed $65M Series C, led by Paradigm (click here to find my recent interview with Antonio Juliano, founder of dYdX)

-

Tim Berners-Lee, credited with inventing the internet, is selling his source code as an NFT

-

Ramp, a crypto payments company, raised $10M in funding

- The price of meme tokens soared after being added to Coinbase Pro

What Do You Meme?

What’s Poppin’?

Ethereum gas fees are plummeting as users move to layer 2 solution Polygon.

According to The Block, the average gas fee on Ethereum has dropped 90% over the past month, falling from $45 to $4.5.

The low gas fees could stem from several issues. Most obviously, the falling gas fees can be explained by a down market.

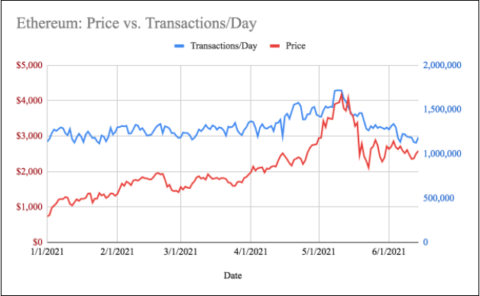

May and early June have been a predominantly bearish period for crypto assets. Ethereum was not an exception. The blockchain has seen a substantial dip in both price and transactions per day in the past month.

As gas fees are extracted based on the amount of computational effort required to execute a specific operation on Ethereum, it follows that with less demand for blockspace and computational effort, gas fees would fall.

For context, transactions per day on Ethereum have fallen from a peak of 1.7M a day back to about 1.1M, which equates to roughly a 35% drop in daily transactions. This aligns quite nicely with Ethereum’s current price of about $2,500, a ~40% decline from the May ATH of $4,168. (data from Etherscan.io and Yahoo Finance)

Well, another reason for falling gas prices could be the soaring popularity of Polygon, a proof-of-stake layer 2 solution built on Ethereum. Based on data from polygonscan.com, over the past two months, spanning from April 14th-June 14th, Polygon has seen its daily transactions balloon from just over 393,000 to 7.3M — a number that dwarfs Ethereum’s 1.1M transactions per day.

Shockingly it seems that Polygon may be attracting more users than Ethereum itself. CoinDesk reports that, as of June 13th, there are three times more active addresses using the Polygon version of SushiSwap than on the Ethereum base layer. Similarly, as highlighted by DappRadar, Aave did twice as much transaction volume on Polygon than on Ethereum during May. According to The Block, there are already 350 DeFi projects in Polygon’s ecosystem.

In related news, I was just able to book Polygon’s Jaynti Kanani for Friday’s podcast. I am looking forward to hearing about Polygon’s massive growth, along with his answers to questions about the trade-offs that come with scaling versus the security of a network (more on this here and here).

Recommended Reads

- Linda Xie on crypto composability (5 min):

- Packy McCormick and Jill Carlson on zero-knowledge proofs (8 min):

- John Street Capital on DeFi (40 min):

On The Pod…

-

what I think about the relationship between psychedelics and crypto

-

the most entertaining guest I’ve interviewed on Unchained

-

why Coinbase founders may have a more impactful future on crypto than Ethereum founders

-

which show has been the most impactful

-

why I am a “nocoiner”

-

where I believe DAOs fit into the future of crypto

-

who my favorite guests have been over the years

-

what I am most fearful and most hopeful about in the crypto space

-

why I think user-friendly products are so important moving forward

-

which DeFi projects I find the most interesting

-

what sort of expenses go into producing Unchained

-

which topics I would like to cover in the future

-

the most surprising answers I have received in an interview (feat. CZ and Vitalik)

-

what three cryptos I think will be most important three years from now

-

if I think I have interviewed Satoshi 🙂

-

my advice for anyone looking to change careers and go crypto

-

who has been the hardest person to book on Unchained

-

what crypto trend has surprised me the most in the past five years

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Nov. 2nd. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians