September 22, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

Sorare, an NFT platform and marketplace (and, disclosure: a current sponsor of my shows), announced a $680 million Series B.

-

The Avalanche-based DeFi protocol Vee Finance lostroughly $35 million in crypto to an exploit on Tuesday.

-

Decentralized Social, a new blockchain, was launched by the BitClout creator, with over $200 million in funding from a16z and others.

-

Blockdaemon, a blockchain tech company, raised $155 million at a valuation of $1.26 billion.

-

Coinbase fully released its Prime crypto brokerage program to institutional investors.

-

Large banks, including JP Morgan Chase and Deutsche, pushed back against new rules proposed by the Basel Committee which would impose strict capital requirements on bitcoin exposure.

-

The US Treasury Department announced it will sanctionSuex, a cryptocurrency exchange operating primarily out of Russia, for its alleged role in laundering $160 million in ransoms for cyberattacks.

-

According to documents leaked to CoinDesk, Chainalysis, a blockchain analytics firm, owns and operates walletexplorer.com, a block explorer, which the company uses to scrape the IP addresses of suspicious users in order to catch bad actors.

-

Binance plans to stop offering futures, options, and leveraged token products in Australia by December.

-

Coinbase is preparing to suggest to federal regulators how they should oversee the crypto industry.

What Do You Meme?

What’s Poppin’?

Yesterday, Securities and Exchange Commission (SEC) Chair Gary Gensler described the cryptocurrency industry as a field “rife with fraud and abuse and hucksters and the like.”

Gensler’s strong words came during a live interview with the Washington Post, where Gensler reiterated his stance that he wants to bring crypto under the public policy umbrella.

This means instituting investor and consumer protections, and quickly, so that “there’s never a spill in aisle three,” as Gensler put it. To get ahead on crypto regulation, it appears that Gensler feels a broad regulatory stance is necessary. Gensler explicitly called out three sectors of the cryptocurrency industry that deserve increased scrutiny: unregistered tokens, lending products, and stablecoins.

On unregistered securities:

“And think about it, those projects, those five- or six thousand projects are raising money from the public. What else is an investment if it’s not raising money from the public anticipating profit, and the public is hoping for a better retirement or a better vacation next year if they make some money on this crypto or that crypto?… So, I don’t think there’s a long-term viability for five- or six thousand private forms of money. History tells us otherwise. So, in the meantime, I think it’s worthwhile to have an investor protection regime placed around this.”

On lending platforms:

“I think it would be better–the platforms that are trading securities, the platforms that have lending products, who have what’s called “staking products,” and I’m glad to describe that for your listeners, but where you actually put a coin at the platform and you earn a return–that they come in and we sort through, figure out how best to get them within the perimeter. We’ll also be the cop on the beat and bringing those enforcement actions, as well.”

On stablecoins:

“Stablecoins are acting almost like poker chips at the casino right now, so add to the Wild West analogy — we’ve got a lot of casinos here in the Wild West and the poker chips, these stablecoins, at the casino gaming tables. So I think there’s just a lot of warning signs and flashing lights.”

To accomplish the crypto industry regulation, Gensler hinted at inter-governmental coordination, saying that he expects “there would be some help from Congress.” He went on to add, however, that “in terms of the SEC, I do think that we have robust authorities” to enact regulation.

Recommended Reads

- Here is the full interview with the Washington Post:

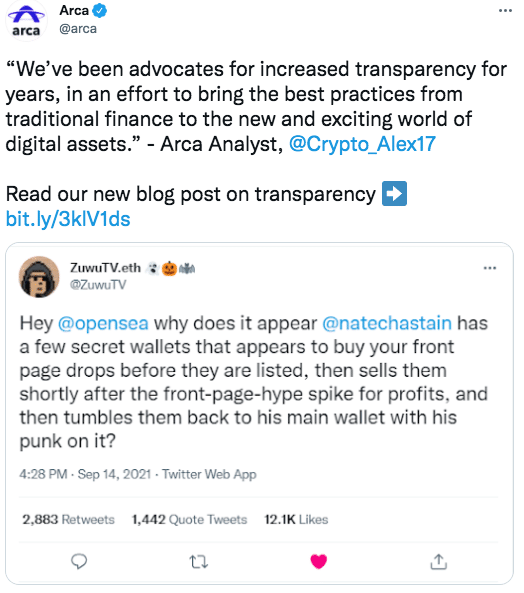

- Arca on crypto and transparency:

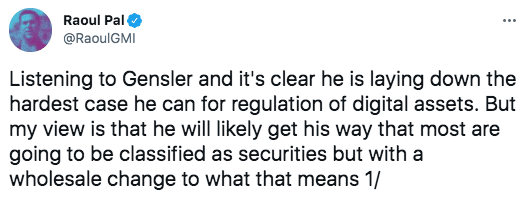

- Real Vision’s Raoul Pal on digital assets and securities law:

On The Pod…

How OG Crypto Artist Rhea Myers Sold a Never-Seen Artwork at Sotheby’s

Rhea Myers, artist, hacker, writer, and senior smart contract developer at Dapper Labs, has been making crypto art before NFTs were a thing. Check out this episode to learn about Rhea’s work as an OG crypto artist, why she believes concerns over NFT energy consumption are overblown, and how NFTs are changing the art world. Show highlights:

-

- Rhea’s experience entering the crypto space

- what inspired her to make Bitcoin-based transaction art

- what blockchain art she was creating in 2014

- how she helped Coin Artist create crypto puzzles

- what Rhea thinks about Cadence, the programming language for Flow

- what conceptual art and blockchain art have in common

- how Rhea minted her soul on a Dogecoin fork

- how Rhea came up with the idea of Secret Artwork (Content), which was recently sold at a Sotheby’s auction

- what cryptographic elements influenced Secret Artwork (Content)

- why Rhea was wrong about how the NFT industry would evolve

- why Rhea believes concerns over NFT energy usage are overblown

- how NFTs are changing the art world

- what Rhea thinks about the NFT DAO movement

- what about NFTs make them so fascinating, in a legal sense, to Rhea

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians