August 9, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

Brian Brooks resigned as CEO of Binance.US on Friday.

-

Axie Infinity is the first Ethereum-based game to hit $1B in sales.

-

Christie’s art house to hold an auction featuring Beebits and Bored Ape Yacht Club NFTs

-

Over $40M in ETH has been burned since last Thursday’s London hard fork.

-

Bitcoin trading activity on Genesis, a cryptocurrency lender and trading desk, declined from 80% to 47% from Q2 2020 to Q2 2021.

- More capital has flowed into stablecoins than US municipal bonds since Jan 1, 2021.

What Do You Meme?

What’s Poppin’?

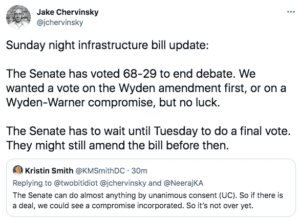

Last night, the Senate voted in favor of ending debate regarding the roughly $1T bipartisan infrastructure bill before voting on any amendment to the crypto provision. Senators voted 68-29, easily obtaining the necessary 60 votes to end the debate. The bill is almost ready to go to the House, but could still be delayed by up to 30 hours in the chamber, giving the crypto industry a bit more time to work out the controversial language found within the bill regarding crypto taxes.

This puts the infrastructure bill, and its concerning language regarding crypto taxes, basically back to square one. According to Jason Brett, a blockchain policy expert, “The Senate just moved to have a vote that would be a 32-hour debate period prior to a vote on the language AS WRITTEN in the bill.” He continued, “This means the language everyone did not like that was overly broad will now stay as is. I believe there will now be 32 hours of debate and then there will be a vote in the Senate like on Tuesday.”

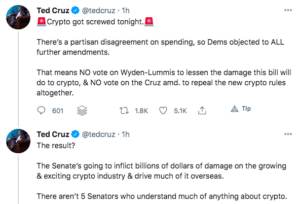

Senator Ted Cruz believes that last night’s events “screwed” crypto.

As a refresher, the original language found within the infrastructure bill would implement stricter reporting rules on crypto brokers in order to bring in $28B in taxes over the next few years. The provision would require crypto “brokers” to report customer gains via a 1099 and any transactions over $10,000 to the Internal Revenue Service.

The provision has received quite a bit of backlash from the crypto community over the broad definition of a crypto “broker.” Kristin Smith, executive director of the Blockchain Association, told CoinDesk, “We interpret this to mean software wallet developers, hardware wallet manufacturers, multisig service providers, liquidity providers, DAO token holders and potentially even miners,” would be considered a “broker” under the original language of the bill. Such a requirement would force pseudonymous, decentralized protocols to collect and enforce know-your-customer (KYC) information — an impossible task in crypto.

On Wednesday of last week, Senators Ron Wyden, Pat Toomey, and Cynthia Lummis proposed an amendment to narrow the definition of a broker, explicitly excluding non-financial intermediaries, like miners and validators, from reporting requirements. This new language would have cleared the way for miners, developers, stakers, and other entities who move crypto assets, but do not have customers, to sleep soundly in the US.

On Thursday, Senators Sinema, Warner, and Portman proposed their own competing amendment to the infrastructure bill, which received formal support from the Biden administration. The amendment initially only protected validators and miners from proof-of-work blockchains, like Bitcoin, while validators on proof-of-stake networks, like Ethereum 2.0, would still be required to report.

The Sinema-Portman-Warner wording was revised on Saturday to exempt both PoW and PoS, but not other consensus mechanisms. Furthermore, according to Coin Center’s Jerry Brito, “it still does not protect protocol devs.” Brito added, “Unfortunately the revised Warner amendment is still not as good as the Wyden-Lummis-Toomey amendment. It does not exclude protocols devs who are not middlemen and should not be considered brokers.”

However, according to Messari’s Ryan Selkis, the Sinema-Portman-Warner amendment is not on the table anymore and the Wyden amendment will most likely not get any floor time today. “We either get to the Wyden amendment or it’s the original language,” Selkis explained on Twitter. He also added, “At this point, it looks unlikely Wyden will see any floor time. That means this piece of shit gets flung back to the House, which can offer its own amendments.”

For now, it appears that there is a 30-hour window for crypto lobbying to work its magic.

Recommended Reads

- Kevin Rooke on the Lightning Network:

- Mario Gabriele, writer of The Generalist, on FTX:

- NFT artist PPLPLEASR on how crypto changed her life:

On The Pod…

With 30 hours left to fight for pro-crypto language in the infrastructure bill, what can you do? Blockchain Association’s Kristin Smith gave the answer out during last Friday’s pod:

You can watch the full episode here: https://www.youtube.com/watch?v=CIqmj3ETwZw

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians