June 23, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

Stronghold Digital Mining, which turns waste coal into electricity for BTC mining, announced a $105M funding round.

-

Sotheby’s will accept bitcoin or ether in an upcoming auction estimated to reach $10M.

-

CipherTrace, a blockchain forensics company (and disclosure, a former sponsor of my shows), raised a $27.1M Series B.

-

Canada’s Ontario Securities Commission has charged Bybit with “operating an unregistered crypto asset trading platform.”

-

Blockchain Capital closed a new fund with $300M in backing, including PayPal and Visa as backers.

-

Iran has seized 7,000 mining computers since its mining ban in late May.

-

On Friday, FATF plans to finalize its guidance on crypto regulation.

-

Polkadot’s DOT token rose by 70% in just four hours on Coinbase.

-

MicroStrategy’s most recent bonds are trading below face value; The Block reports that large, publicly traded companies are not following MicroStrategy’s lead into Bitcoin

What Do You Meme?

What’s Poppin’?

Yesterday saw Bitcoin drop below $30K for the first time since January, while ether settled beneath $2K for only the second time in three months.

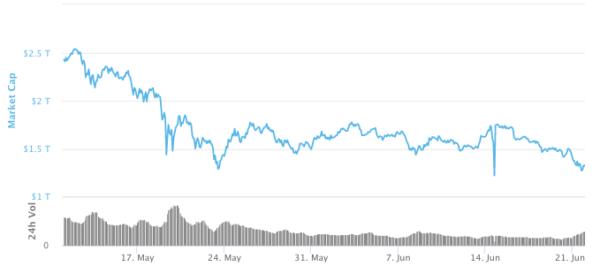

Since May 12th’s peak of $2.53T, the total cryptocurrency market capitalization has sunk back to roughly $1.3T, marking a 48% decrease (at publishing time).

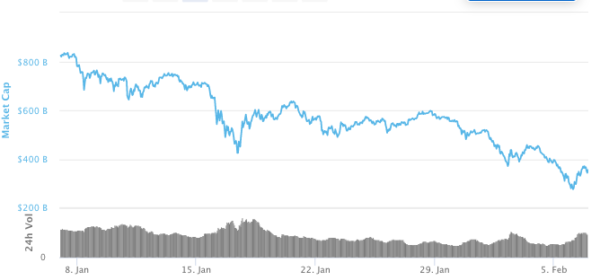

Such a significant correction is not unprecedented at the end of a bull market. In 2018, the total cryptocurrency market cap raced to a high of $834B on January 7th before falling to roughly $280M by February 6th — nearly a 66% decrease in barely a month.

However, not everyone looking at the charts sees a bear market.

Mati Greenspan, the founder of Quantum Economics, a crypto and financial analysis firm, told CNBC that “we may never see another crypto winter again.” He argues, “there’s a lot more utility, adoption, and diversification in the industry than we had in 2014 or 2018.”

Willy Woo, an on-chain analyst, told CNBC that “We are far from a bear market, only traders are freaking out over technicals seen on exchanges like volumes and price actions.” On Twitter, Woo posted a chart showing a bullish indicator based on the ratio of coins held by strong hands versus speculative hands. The chart shows the price of BTC dipping while strong hands accumulate.

Stephen Kelso, head of markets at IT Capital, told CoinDesk that he sees a “buying opportunity for investors,” noting that “Bitcoin is currently trading approximately one-third below its long-term exponential trend line,” which has only happened for 20% of BTC’s history according to Kelso.

Recommended Reads

- Why DeFi needs to address its miner-extractable-value problem:

- Ivan Martin on Malta… sneak peek: “Some €60 billion in cryptocurrency and other virtual assets moved through Malta after it first announced itself as the ‘blockchain island’…”

- Nic Carter on Bitcoin hashrate migrating out of China:

On The Pod…

Is Quadriga’s Gerald Cotten Still Alive? The ‘Exit Scam’ Podcast Aims to Answer

Aaron Lammer, author and host of the Exit Scam podcast, recounts the mysterious and controversial death of QuadrigaCX’s founder Gerald Cotton. Show highlights:

- A quick recap of QuadrigaCX

- why Aaron felt compelled to create a series on QuadrigaCX

- how Gerald Cotton, a lifelong Ponzi-addict, came to be the CEO of Canada’s largest crypto exchange

- what Ponzi-schemes Gerald ran before starting Quadriga CX

- why customers trusted QuadrigaCX and what red flags were readily apparent looking back

- the sketchy tactic Gerald used to single-handedly boosted QuadrigaCX’s trading volume by 30%

- a new wife, empty wallets, a hastily written will, and the circumstances surrounding Gerald’s shocking death

- how Gerald’s dark web background might have prepared him to fake his own death

- what the chances are that Canadian authorities exhume Gerald’s body

- why Aaron is skeptical Gerald’s wife was “in” on the QuadrigaCX fiasco

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Nov. 2nd. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians