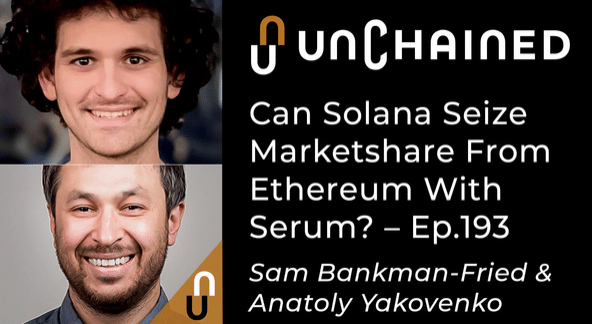

Sam Bankman-Fried, the CEO of FTX and Alameda Research, and Anatoly Yakovenko, the co-founder and CEO of Solana Labs, discuss the Project Serum ecosystem that they are building on the Solana blockchain, and the unique approach to scaling the Solana blockchain is taking.

In this episode, they talk about:

- their backgrounds, and how they became involved in crypto

- why Solana takes a different approach to scaling and how it is implemented

- why they think a relatively lower number of nodes is sufficient to protect from attacks or collusion

- what the vision for Solana is, who they see using it, and how Serum fits into that vision

- why they think there haven’t been more crypto projects migrating to Solana yet

- Solana’s proof-of-history algorithm and how it works

- how Solana plans to attract DeFi developers

- why Serum was made interoperable with Ethereum

- the types of traders they are hoping to attract with Serum, and what their experience will be like on the platform

- why Project Serum is an ecosystem and not just an order book exchange

- how high-frequency trading firm Jump Trading came to adopt Serum

- how Serum will manage trading tokens from different chains

- the purpose of Serum’s two tokens, SRM and MSRM

- and what’s in store for Project Serum in the future

Thank you to our sponsors!

Crypto.Com: https://www.crypto.comGods Unchained: https://playgu.co/unchainedpod

Episode links:

Anatoly Yakovenko: https://twitter.com/aeyakovenko

Solana: Solana.com

Sam Bankman-Fried: https://twitter.com/SBF_Alameda

Project Serum: https://www.projectserum.com

Project Serum on Twitter: https://twitter.com/projectserum

Solana CoinList auction in March: https://www.theblockcrypto.com/linked/59952/blockchain-project-solana-raises-1-76m-from-its-launch-auction-on-coinlist

Solana network stats: https://explorer.solana.com

The Block Research on Solana: https://www.theblockcrypto.com/genesis/76615/solana-blockchain-overview

Proof of history:

https://medium.com/solana-labs/proof-of-history-a-clock-for-blockchain-cf47a61a9274Serum: https://www.theblockcrypto.com/daily/72924/ftx-dex-serum-solana-blockchain

Tether: https://medium.com/solana-labs/tether-to-bring-usdt-to-the-solana-network-77864184b20Jump

Transcript:

Laura Shin:

Hi everyone. Welcome to Unchained, your no-hype resource for all things crypto. I’m your host Laura Shin, a journalist with over two decades of experience. I started covering crypto five years ago, and as a senior editor at Forbes was the first mainstream media reporter to cover cryptocurrency full-time. Subscribe to Unchained on YouTube where you can watch the shows of me and my guests. Go to YouTube.com/c/UnchainedPodcast and subscribe today.

Crypto.com Crypto.com – the crypto super app that lets you buy, earn and spend crypto – all in one place. Earn up to 8.5% per year on your BTC and more than 20 other coins. Download the Crypto.com app now to find out how much you could be earning! Gods UnchainedThis show is sponsored by Gods Unchained, the digital card game that offers true ownership to players. It’s fun, engaging, competitive and has more NFTs than any other Ethereum game on the market. You can try the game out at https://playgu.co/unchainedpod

Laura Shin:

Today’s guests are Sam Bankman-Fried, CEO of FTX and Alameda Research and advisor to Project Serum, and Anatoly Yakovenko, co-founder and CEO of Solana Labs. Welcome, Sam and Anatoly.

Sam Bankman-Fried:

Thanks for having us.

Anatoly Yakovenko:

Yeah. Thank you.

Laura Shin:

Let’s start with each of your backgrounds. Sam, you have your hands in a number of different things in crypto, plus you’re famous for your tweet threads, and I have often seen a lot of people on Twitter wondering when you sleep. So, why don’t you tell us how you came to be involved in crypto and what are all the things that you’re working on?

Sam Bankman-Fried:

Yeah. So, yeah. I guess my background. I went to MIT, sort of had no idea what I was doing there, stumbled into finance, ended up being a quant trader at Jane Street Capital, and partially because it was an opportunity for me to potentially be able to donate a lot of money and partially because it was just a really good environment, and I really liked it and they were very good to me and it was sort of an exciting job. So, I was there for a bit over three years, and then 2017 happened and I sort of had an itch to start something, an itch to, you know, go on my own and try building something. So, I left and ended up starting Alameda Research, which is a crypto quant trading firm, and so it does, you know, arbitrage, quantitative trading, OTC trading, market making, and things like that across the crypto ecosystem, you know, trading something like a billion dollars a day notionally, and you know, that was sort of like chapter one in crypto for me, and then later on in ‘20, I guess spring 2019 I started up FTX, which is a, you know, a global crypto derivatives exchange, and kind of been growing that out too. It’s also, you know, somewhere around a billion dollars a day of notional, and then, you know, more recently I started up Project Serum, which is a decentralized ecosystem built on Solana, and then to sort of like get to your point about, you know, doing a lot of things, and you know, how I manage that.

I mean, I think part of this is that, you know, I have this itching and I get super impatient if I feel like I don’t have enough on my plate. If I feel like I have more slack then I start to feel like oh, boy. There’s something I can do with that, and so it’s sort of, you know, the things I do naturally expand to fit that, and I think really a huge part of this is having a team that I trust, and I think that’s something which like there are a lot of really good teams in crypto, but even there’s a lot of really bad ones, even a lot of the good teams don’t have trust, and so it’s like you don’t have the ability to grow beyond yourself in some ways, and so anyway. That sort of helped a lot. So, I nap now and then. I have, you know, beanbags under my desk as has been photo’d. It’s a, you know, bed in a side room at the office, and you know, I’ll often just like get a few four-hour naps in, and you know, go back to shitposting on Twitter in between.

Laura Shin:

And Anatoly, how about you? How did you come into this space and what do you do at Solana Labs?

Anatoly Yakovenko:

I guess I’ll start with my background too. I went to school in Urbana-Champaign like ’99-2003. So, I was there through the dot-com crash, and I remember my advisors telling me that like computer science might not be a good career choice, but I had actually one of the Solana Labs co-founders, Greg and I and a couple others folks had a start-up doing voice to read stuff. It didn’t pan out because of dot-com crash, but we ended up at Qualcomm. I spent like most of my career working in optimizations like kind of trying to make this like, you know, this was at like, you know, before iPhones, right? We’re trying to take all this desktop complicated software and stuff it into effectively like a microcontroller, but a system that people were calling a phone and try to make it work.

So, that was like kind of where I cut my teeth as an engineer, and it was a ton of fun and always like kind of a constant challenge, and Solana actually comes from that like period. Solana Beach is a town in San Diego where we used to kind of…we like, you know, wake up, surf, bike to work, bike home, surf again. That was a fun decade. I ended up in San Francisco in 2017 and just kind of saw this like crazy boom for crypto during that time and at a start-up with another one of the Qualmcomm co-founders, Steven, we were trying to…this was like a side gig. We were trying to buy deep learning hardware and offset the capital costs of those with crypto mining, right? Like, I’m sure there’s people pitching this stuff still, but like this was purely for fun, right? Like, how do we get a bunch of DPU cards together and do something fun with it? But both of us started really like thinking about like what is proof of work? Why does it work? Why is it interesting? And I had this lightbulb moment, literally had like two coffees and a beer, was up until four in the morning, and I realized that you can use the same, you know, pre-image resist and hash function, but instead of measuring how much entropy goes into the puzzle you can measure how much time goes into the puzzle that it solves.

So, and like once a lightbulb went off I had this, you know, like I realized that all the stuff we worked on at Qualcomm, like this decade of like working in wireless protocols, like optimizing stuff for communication, it’s all applicable in blockchain because all you really need is a source of time outside of the system like before consensus, and that was really kind of the foundation of the company. I was kind of lucky in the timing too. There was an attempt to buy Qualcomm by Broadcom and like a bunch of people weren’t happy and were kind of scattering to like the Googles and Facebooks of the world, and I knew a lot of the super senior like operating systems like network people and got them on board to join up and build this thing, and philosophically we kind of took everything that we learned from optimizing mobile platforms, mobile operating systems and port it into a layer-1. I think we kind of have this unique perspective that we should always be building for hardware that’s going to come out two years from now, which a lot of folks I think don’t have in this space.

Laura Shin:

So, for listeners who are maybe wondering why they’re on the same show, hopefully you figured out if you don’t know about Project Serum that it is being developed on Solana, and so there’s a lot of interesting things to mine around this issue of, you know, stuff that Anatoly mentioned, and yeah just around scaling and different layer-1s, and where things are going to go, but let’s actually maybe just dive into the main problem that…well, as far as I can understand that I think you were trying solve at Solana, which is around scaling. Here we have a lot of layer-1 chains that are attempting to solve this with a technique that’s called sharding, which spreads validation across the blockchain into smaller pieces, but that essentially makes each shard its own blockchain, which then makes it harder for decentralized applications to interact with each other across the shards, and Solana takes a different approach to scaling. How do you do it and why did you take a different approach?

Anatoly Yakovenko:

Well, I’m actually like curious why people didn’t take our approach, but basically this comes down to like…like the foundation to limit telecommunication is like the Shannon-Hartley theorem, right? You have noise. You have power, and you can stuff as many bits as you can, and you can increase power to overcome noise, but the bandwidth of the channel, like how much bandwidth you have is the limiting factor, and this is true for like complicated systems like layer-1s or like radio towers as well. So, like when you see, you know, like what does…like 4G to 5G, it’s literally just using a wider set of frequency bands, like just more bandwidth, right, to stuff more information through these pipes, and the way we approach this in like mobile is to use more hardware, use more cores, more silicon because this stuff is improving at an exponential pace. Every two years, somebody’s going to double capacity. Like, we just saw Nvidia release a card, 3090 or whatever, that’s got 10,000 cores.

So, from our perspective like when you have something like a blockchain, which is limited by, you know, like how many participants you can concurrently keep track of and how many packets per second you can send across a network and how many folks you can talk to, there are fundamental limits to these algorithms, right? R and D has been done already, right, since the ‘80s and ‘90s, and our approach is then okay, well, how do we increase the bandwidth of this thing just to horizontally scale it on as much hardware as we can and two years from now it’ll be double that, right? And like this is an exponential curve that you just really can’t fight. Like, if you’re fighting against this curve, you’re going to lose. So, fundamentally this has been our approach to scaling this, but another kind of philosophical reason why we went for this path is that I think if you get rid of the store of value as a use case, and I’m not sure you can argue that proof of stake networks are fundamentally store of value, what you’re left with in a smart contracts platform is price discovery, right? You have a single like kind of engine for state transitions. So, state transitions have financial value and everybody in the world is trying to extract free money out of it. It is by definition like an exchange, right? It’s not like a spot exchange where you have bids and asks and things are kind of simple, right? You have these really complicated programs that can do arbitrary things, but you look at this giant mound of state machine and you do your best to figure out hey, is there any free money here? If there is, I’m going to send a transaction to get it, right, and everybody in the world is doing this.

So, if that’s the case, right, if our only use case is price discovery, then what we need to build is something that is moving as fast as the news, that a state transition occurs somewhere…like, I mean, a meteor strikes in a cornfield, right, and we need to change the price of corn, that should reflect across the world as fast as, you know, information travels through fiber, right, and our job is to like get those state transitions replicated across the entire world as fast as we can. So, this is kind of like the use case that we’ve been building for and how we’ve been approaching this problem, and I think kind of like it was awesome to meet Sam because I think he kind of…like I remember him actually saying this like in our conversation that we only really need to be as fast as the news, and this was like the first person I actually talked to that realized like I think had the same intuition about the world that like stuff that’s faster than the news is just trading statistical noise. It’s not actually important.

Laura Shin:

This is so fascinating. I love the way that you described that about how a blockchain is almost like an exchange and people send transactions to try to extract value. I love that description. Yeah, and I just actually also wanted to quote from Kyle Samani of Multicoin Capital who has invested in Solana, and he just described, you know, something about the layer-2 issue, which the way he expressed it was so fascinating to me because mainly because so many developers are working on layer-2 solutions. He wrote “developers building smart contracts don’t want to deal with layer-2 and sharding, or cross-shard applications state and logic, or cross-shard latency, or security models and sidechains, or liquidity routing and state channel networks, or how they might run computations off-chain using zero-knowledge proofs. The entire point of having a smart contract chain is that the chain itself abstracts all of the lower level complexities, an economic system necessary to deliver trust minimized computation allowing developers to focus on application logic.”

So, yeah. That was really interesting the way he expressed that because, like I said, everybody is working on layer-2, but something else I wanted to ask you was that you’ve said that Solana can handle 60,000 transactions per second, and right now I think Solana has about 130 nodes. So, you know, on the other hand, Bitcoin has over 10,000 nodes. Ethereum has about 9,000. Do you think that 130 nodes is sufficiently decentralized to not be vulnerable to attacks or even collusion as some people have surmised has happened with EOS, which also has a limited number of nodes?

Sam Bankman-Fried:

So, all…I mean, I’m interested in what you say. I’ll say like one thing that I’ve noticed here is like, you know, what exactly do you mean by decentralization? Because, you know, one sort of interesting thing worth noting is that like if you look at, for instance, Ethereum as it is right now, and you look at the miners who control the security effectively of this. You know, the distribution of hash power by miners, it’s the top three have more than half the hash power, and it’s in fact getting like a little bit less decentralized than like the Solana validators are right now. It’s also like it’s obvious that Solana like launched recently and that number is sort of like growing exponentially, but that’s just like one thing that strikes me whenever people ask about sort of like number of nodes on it is like, you know, what’s the goalpost here?

Anatoly Yakovenko:

I think this is like a key question and this isn’t like a question about like us versus Ethereum because I think this is a question for like the Chief Security Officer at like Visa who is going to take a bet on running stuff on these networks, and how do they analyze security and censorship, right? Like, how do they actually like…how are they going to approach this problem? Assuming like everything we say is meaningless, right, like from their perspective, words are meaningless, what is my risk that I’m taking by using any one of these networks? And the way I think you can analyze this is you can look at whatever algorithm you’re using. Nakamoto, PBFT, there’s some threshold to where the network breaks, right, and then what is the minimum number of machines that I need physical entry to get to that threshold? It’s proof of work. It’s actually like 51 percent will get you there, right? It’s lower than that, but it’s…without arguing with anybody, with any professors, 51 percent is clearly that. With proof of stake, it’s 33 percent. In some cases, it’s a little higher depending on how you tweak things.

So, then the job of like…like when we ask what is decentralization? It’s that minimum set. In Ethereum it’s pretty low, and so in Bitcoin as well. We kind of run in this world where we don’t have any like attackers on these main networks because the reputational cost is just too high, but you see stuff all over on Ethereum Classic, right? So, like if the CSO of Bitcoin, or like a Chief Security Officer of Visa is going to look at how do I deploy money on Ethereum? They’re going to sandbox that risk assuming the network can easily be taken over. So, like they do things like Circle and USDT where they effectively control the funds and they honor the redemptions when they feel like it, right, and they can freeze your accounts and things like that, but at the end of the day the funds are at like Bitfinex or Circle, right, and this is how like I think where these networks are still immature, even what we consider mature ones, like Bitcoin or Ethereum.

When you look at proof of stake, Tezos, Cosmos, every proof of stake network right now out there have about like less than eight entities that control 33 percent of the network. So, those numbers are still pretty small. Our testnet, called Tour de Sol, it’s about 90. So, it’s like 10 times bigger than that. Our mainnet is about eight as well, and that’s simply because of stake distribution, right? Like, capital when it’s lazy, it just kind of goes to a single spot, and it’s got this Pareto distribution where most of the top-tier validators attract the most capital, right? Most of the top-tier mining pools attract the most hash power, and this is what’s keeping these networks centralized, and it’s not really a question of how many copies of the ledger you have, how many full nodes you have, but that’s a meaningless number. It doesn’t add to the security. It’s not going to make like the Chief Security Officer of Visa feel any better if there’s 10,000 copies of the ledger if three mining pools can basically break all their assumptions about security.

Laura Shin:

Okay. So, I don’t know if I like really understood every last thing that you said, but essentially what you’re saying is that the way I frame the question is not…like the comparison doesn’t really make sense because of the fact that there are these concentrations of power where if you do know the three people, who when you add them up together they can collude, then you can target a small number. So, in a way it doesn’t matter than Solana has a small number. Is that what you’re saying?

Anatoly Yakovenko:

We actually…well, so one point is our mainnet is about 180 full nodes, validators. Our distribution on testnet is about 480. So, it’s much, much, much higher than just like 3 or 5, but the number of full nodes in any network…

Laura Shin:

Right, but you were saying it’s three for Ethereum.

Anatoly Yakovenko:

So, the number of full nodes that add up to some meaningful threshold in the consensus is what matters, not the total number of full nodes because the copies of the ledger are meaningless. Like…

Laura Shin:

Right. Okay. Yeah. That’s what I thought you were saying. Okay.

Sam Bankman-Fried:

I was saying in some sense it’s actually a lot of chains could probably use quite a bit more decentralization in, you know, the effective weight of who’s validating these or producing these blocks, and I think that includes almost every chain in the world. If you’re not willing to rely on things like reputation and people, you know, not wanting to nuke and get fully slashed in order to try and attack a chain, but another thing I think worth noting, and I think this is almost like commonly misunderstood, and I had this misunderstanding until I thought about it, is that you could scale up the number of validators on Solana. You can scale it up a lot, and like, you know, it’s sort of has been growing and probably will keep growing if the network keeps growing, you know, if the number of users do, and the key thing is it doesn’t like really hurt performance that much. So, it’s not like this is the only way it can get this number of blocks through is by having this number of validators. Now, Anatoly knows way more about this than I do, but it’s not a fundamental limitation, you know, in any way.

Laura Shin:

Okay. So, it’s not like EOS where like they had to have a small number of validators to keep that high throughput?

Anatoly Yakovenko:

So, when we say like, and this really surprised me in the industry, like that people weren’t measuring TPS this way. Like, for us, TPS is a meaningful number because our consensus message is our smart contract transactions. So, our capacity to process like transactions, like Serum transactions or payments, is the same as the number of consensus messages we can use, and that what’s limits the validator stuff. So, like to me, like doubling TPS but not doubling the number of validators that can participate in consensus is like almost like a joke, right? Like, that’s not like a meaningful doubling of anything interesting, right? Like, it’s kind of like you’re cheating, right? Like, you’re stuffing more like kind of fake transactions into a single, meaningful one, and batching a bunch of them and delegating that decision to somebody else.

So, kind of like for us, right, the way I see it is like for this space to succeed we need to get to a point where we have like 3,000 machines that are required for somebody to get physical entry to stop the network, and at this point like somebody that’s like a Visa or Mastercard are going to look at this network and be like well, it’s probably mathematical impossible to go do this, right, to do this attack, unless there’s like a bug in the technology itself, right, but like actually physically go find these 3,000 people and break into their setups and get ahold of their private keys and then sign invalid state, right? That’s kind of an insurmountable problem, and at that point we will start being competitive with real regulated financial networks. So, for us, every time like Nvidia doubles their cores, right, we double our capacity for TPS, which doubles the number of validators that can participate in consensus, which allows us to get to that meaningful number where somebody that’s at Visa or Mastercard just kind of gives up. They’re like oh, okay. This thing is just impenetrable. Like, let’s go use it because it’s cheaper. It’s less of a headache, right, like to actually go use this versus deal with the red tape and like all the other stuff that they do, and this is, to me, kind of what we’re striving for as fast as we can. So, on our testnet we are running this autonomous staking agents that people are running instead of staking directly, and this is what allows us to evenly distribute the stake across almost all 500 validators, and this is why it takes over, you know, around 100 or so to get up to that 33 percent number, and when the validator set doubles we can keep increasing this kind of meaningful decentralization threshold.

Laura Shin:

You keep mentioning Visa and Mastercard, and I have to say this has thrown me for a loop. So, you’re envisioning the likes of Visa and Mastercard wanting to use Solana. Is that it?

Anatoly Yakovenko:

I think Sam is you know, an entrepreneur that’s way ahead of his time, right, because he has vision that like a good chunk of finance is going to run on these systems because they’re just better, right? Like, they don’t require any people, right? You build a software. It runs on this thing that cannot be broken into, right? There’s no like…all the cruft is taken care of, and like there’s other people like that that want to take down Visa and Mastercard, right? And…

Laura Shin:

So, okay, but…

Anatoly Yakovenko:

They’re out there, right?

Laura Shin:

But your like target, like who do…what’s your vision for Solana? Like, who will use it and what it will be used for? Because yeah. For you to keep talking about Visa and Mastercard was not what I was thinking.

Anatoly Yakovenko:

I guess the way I see it is if we get to like a number, we meaningfully have meaningful censorship resistance. Like, it takes, you know, 1 to 3,000 machines to break into to censor the network, we can start moving real finance over, right, from traditional finance to these systems, and the early adopters are going to be folks like Serum because they’re cryptocurrency traders who already get it, right, but who knows? Maybe Sam starts a large-scale credit card company next, right, like and starts competing directly with Visa and Mastercard because he sees the attack is there and it’s super easy for like a million people in Malaysia to aggregate funds to lend to a mortgage in San Francisco. I don’t know, right?

Laura Shin:

Oh. Oh, so but it would be decentralized?

Anatoly Yakovenko:

Yes. Of course.

Laura Shin:

This is what I was confused about. Right. Okay. So, you were…

Sam Bankman-Fried:

I think it’s like the business model of Visa and Mastercard, like the companies, but you replace their internal ledgers with a public decentralized ledger, and so it’s like you actually take, you know, the heart of the technology of the company and you get it on chain.

Laura Shin:

Okay. Now I get it because I was a little bit like…okay. Now I get it. Yeah. So, you’re talking about a decentralized version of Visa or Mastercard, not the actual…

Anatoly Yakovenko:

Yes.

Laura Shin:

Okay.

Anatoly Yakovenko:

Well, who knows? Maybe there’s some visionary…

Sam Bankman-Fried:

I mean, maybe…

Anatoly Yakovenko:

Productor manger there. Like…

Laura Shin:

What…okay.

Anatoly Yakovenko:

I don’t know, right? Like, I don’t know their organization.

Laura Shin:

All right. This is like getting super speculative, but you know, right now you do have this ability I believe. I’ve seen that you have claimed in other articles that Solana can handle 60,000 transactions per second, but I was checking the stats and right now it’s about 450 or 500. So, why do you think Solana hasn’t yet seen more crypto projects or users migrating to Solana?

Anatoly Yakovenko:

I mean, TPS is kind of like it’s capacity, right? That capacity’s there, but people need to have like a meaningful reason to go use it. It’s like why would I switch operating systems or why would I go from Ethereum to anything, right? Like, this is kind of a build it and they will come, is a really bad way to get product market fit, right? We have to like have a meaningful reason for somebody to go do this, and with Serum they just couldn’t do it anywhere else.

Laura Shin:

Okay. So, we are going to talk about Serum in a bit, but I actually first just want to dive a little bit more into Solana because you use an algorithm called proof of history, which you, you know, sort of alluded to in the abstract earlier. Can you explain what that is and how it works?

Anatoly Yakovenko:

Yeah. So, there’s folks building these things called verifiable delay functions, and there’s some very sophisticated implementations of these that have all these complicated cryptographic tradeoffs. Our approach is what, you know, a bunch of hardware Qualcomm folks would do, which is trial to 56 in a loop that you sample. So, recursive trial to 56. Because it’s recursive, it’s a thing that has to run on a single core or a single thread, and because it’s running in this kind of single thread environment, it is the speed of which it can run is bound by the fabrication process and our modern day fab, like TSMC or Intel or GlobalFoundries, and because that process is kind of so like fine tuned and exact at this point in, you know, in our state of technology, right, like we have a very, you know, somewhat granular but a very good approximation of how much time it takes to generate any number of these hashes. So, we can effectively approximate time based on the number of hashes produced by this process, and for an attacker to increase that number meaningfully, they have to build a better fab, and that’s a 40-billion-dollar investment. So, that’s kind of a very, very expensive proposition for somebody to try to, you know, get something that’s, you know, 10 times faster or something like that. So, from our perspective this is kind of like, you know, you think of proof of work and Bitcoin and ASICs as kind of this physical bound that secures the network. Proof of history, it doesn’t secure the network. It allows us to schedule things in a very kind of compact way where there’s no gaps, and this is what allows us to kind of scale throughput, scale a number of block producers per second, like increase censorship resistance, and you know, process more transactions. So, it’s not a security thing, but without it to maintain a high level of security we would have to reduce throughput.

Laura Shin:

And your block times are counted in milliseconds, right?

Anatoly Yakovenko:

Yeah. So, right now the block time is 400 milliseconds. I would like to get them down to like 80 milliseconds, which is how long it takes for the speed of light to go around the world through fiber.

Laura Shin:

Okay. Yeah. Well, I mean, I can understand for trading on a global market that, yeah, that would be the goal, but yeah. I mean, this is obviously a huge leap in terms of block time because, you know, we started with Bitcoin. It’s roughly every 10 minutes. Ethereum’s like kind of every 12 to 15 seconds. Yeah. So, this is definitely much faster, but one other thing that I just wondered is when I was learning about this proof of history and this like clock problem as I guess it’s called, I was kind of like how is the time of a block different from a block height, right? You know, because like if you’re thinking of time as like just every single…so obviously the way we do time is like, you know, it’s like year, month, day, hour, minute, right, second, but you can create like a unique number from that, and so in that regard you can think of a block height as also like being a unique number. So, then I sort of didn’t understand, like how is proof of history different? It just sort of seemed like a different way to describe the same thing, do you know what I mean? Like, which is a way to put blocks in chronological order.

Anatoly Yakovenko:

So, people think of proof of work, the Bitcoin blockchain, right, you can estimate how much time it took to build it right, but that estimation is interpretating the chain as a source of time after consensus. So, to give you why an idea why that matters is like, you know, first radio towers went up. Two towers transmit at the same time over the same frequency and you get noise, right, because those waves interfere and information can’t propagate through it, right? You don’t know what’s being transmitted. So, really the first optimization people tried is they gave everybody a clock that’s synchronized, and they can alternate by time. So, how well that clock is synchronized, how low the air is between like the drift in the clocks is how fast they can alternate. So, modern day like cellular networks are like roughly every, I think the slice is like five milliseconds at this point, because the clocks are so well timed and so well synchronized.

So, that allows you to increase the number of participants that can transmit per second, and that is exactly the same as the number of block producers that can transmit per second because if you look at Bitcoin, right? It’s got this puzzle that’s designed to be solved once every 10 minutes no matter how big the network gets because if two people solve it at the same time you get effectively an undecided state of the chain, right? We don’t know which is the actual final block, right? So, then that’s noise. That’s a kind of similar problem to the electromagnetic interference. So, with Bitcoin the way they try to solve it is they increased difficulty such that it’s really extremely rare that two blocks occur at the same time. Ethereum is probably the fastest possible implementation of proof of work, like this like once every 10 seconds kind of thing. Our approach is to use this external point of reference as a source of time, which is the number of hashes that somebody has computed, not the actual value of the hashes. It’s just like give me a data structure that shows that you spent like 400 milliseconds somewhere spinning in a single core. Like, prove to me that you waited, right, and because you have to prove for like 400 milliseconds and Sam must prove for 800 milliseconds. That gives you a slice of time to transmit your block, and Sam is forced to delay until your block is done, and then that reduces the number of concurrent blocks in the network and we can effectively kind of start stuffing more block producers in the same second.

Laura Shin:

Oh, so then…because I was going to ask you what happens if two blocks are mined at the same time, but you’re just sort of saying that doesn’t really happen?

Sam Bankman-Fried:

Because its synchronized.

Anatoly Yakovenko:

Yeah. So, it does happen, and that consensus takes over just like it does in proof of work or PBFT or any other chain. It’s just we are…like all of engineering is taking the best case and doing your best, making it the average case most of the time, but that…

Laura Shin:

Okay, and so that’s…so then if there are two blocks that are mined at the same time that’s where your proof of stake part comes in. Is that…?

Anatoly Yakovenko:

Yeah. Yeah.

Laura Shin:

Okay. So, okay. So, we’re going to discuss a little bit more about that in a moment, but first a quick word from the sponsors who make this show possible.

Gods UnchainedThis episode is sponsored by Gods Unchained, the digital card game that offers true ownership to players. Cards are minted on Ethereum, meaning users can trade, sell and program their assets however they like. A new expansion set has just released, with limited edition cards and ERC-20 chests available for sale. If you miss out? You can hunt down these down, or previously sold-out chests, on third-party sites like Uniswap. This game is the real deal: helmed by experienced TCG legend, Chris Clay of Magic the Gathering: Arena fame. It’s fun, engaging, competitive and has more NFTs than any other Ethereum game on the market. You can try out the game at https://playgu.co/unchainedpod. For the DeFi heads out there looking for a new opportunity, why not go grab some chests?

Crypto.com Crypto.com – the crypto super app that lets you buy, earn and spend crypto – all in one place. Earn up to 8.5% per year on your BTC. Download the Crypto.com app now to see the interest rates you could be earning on BTC and more than 20 other coins. Once on the app, you can apply for the Crypto.com metal card which pays you up to 8% cashback instantly on all purchases. Reserve yours now on the Crypto.com app.Laura Shin:

Back to my conversation with Sam and Anatoly. Okay. So, yeah. So, this is because I was, you know, doing all this research and I was like wait. There’s proof of history, but there’s also proof of stake. I was like what is going on? But that is the answer is that if two blocks are mined then the staking comes into play. Is that what happens?

Anatoly Yakovenko:

Yeah. So, staking is the Sybil-resistant portion that is kind of like proof of work solves Sybil resistance with electricity because you can’t, you know, you can’t use the same electricity twice, and we use proof of stake to solve the same problem, but the actual consensus algorithm is based on PBFT, which is Practical Byzantine Fault Tolerance.

Laura Shin:

Okay, which I don’t know what that means. So, do you want to give a really quick description?

Anatoly Yakovenko:

That’s basically the I think, I mean, Emin will argue that Avalanche is not PBFT and its own thing, but I think every proof of stake network at the end of the day is PBFT if it comes to any kind of finality. So, it’s an algorithm that was discovered by Barbara Liskov in ’99 I believe. So, it’s fairly recent if you think about research, and it’s a way to solve the End Generals, Byzantine Generals Problem. Nakamoto, the proof of work algorithm, the consensus algorithm used with proof of work in Bitcoin is another solution to this famous End Generals Problem. So, PBFT is a way to do it with cryptography in some way to do, you know, if you have cryptography and some Sybil resistance you can kind of build these things on top of something that has, you know, good enough communication, like the internet.

Laura Shin:

And the General Problem is, or the way to describe it is basically how to create cooperation amongst different people who don’t know each other and do it in a way where they can kind of communicate effectively. Like, that’s sort of like my very general way of describing it.

Anatoly Yakovenko:

It’s a way for…well, like it’s based on this famous problem, which is called the Byzantine General or the End Generals Problem where, you know, you have some number of generals in Constantinople and if all of them attack at the same time then they win, but if some of them don’t then they lose, and they’re trying to send messengers between each other to coordinate when they attack, and the problem is that Constantinople can, you know, depending how the problem is set up they can, you know, stop the messengers or they can create their own spies and send fake messages and things like that. So, how do you solve this problem under different kind of modes of attack vectors? So, PBFT is one such solution. There’s other solutions that have other assumptions, and Nakamoto is probably like, you know, that’s the most famous one.

Laura Shin:

All right. So, you have this blockchain, which as we discussed has the potential to process orders of magnitude more transactions than existing blockchains, but right now, or at least the most recent number I could find was that there’s only six dapps currently in Solana, or maybe it’s a little bit more than that, and I know, so I know we haven’t talked about Serum yet, but we will in a second, but I do know that Serum is interoperable with Ethereum, and I wondered in general, you know, and this was sort of something that came up earlier in a conversation with Tim, like is that your strategy for getting more activity on your chain to try to attract DeFi developers from Ethereum? Like, what is your playbook for getting activity?

Anatoly Yakovenko:

I mean, like our…so, like I think the space is still really small. Like, if you look at the number of, you know, guess how many GitHub users have coded in Solidity? Like, take a wild guess. Out of the…

Laura Shin:

4,000.

Anatoly Yakovenko:

It’s 840.

Laura Shin:

Oh, really?

Anatoly Yakovenko:

If you just do a query on GitHub, like how many like users have like have code that they submitted in Solidity, it’s pretty small, right?

Laura Shin:

Wow. Okay. That is really small.

Anatoly Yakovenko:

But that’s not to say that like 840 engineers is like a huge engineering company, right? That’s like 200 million a year in ENG burn or something absurd, right? Like, that’s like a lot of people, right, that are building stuff. So, it’s both small and large enough to where it’s kind of…it’s dumb to ignore Ethereum, right? Dumb to bet that something is going to grow bigger than it, and my view on this space is that with proof of stake networks and smart contract platforms you kind of end up in this like kind of fungible block space world where it doesn’t matter where the transactions run, right? It doesn’t matter if like users with some issue token in Ethereum, whether they do the exchanges on Uniswap or do it through Serum, they don’t really care. All they care about is that they have token A, they got token B at some price, right, or they have like both token A and token B and now they’re providing liquidity, right, and earning a yield or something like that. They just want to interface with crypto systems, right? They don’t really care about Ethereum unless they’re Maximalists, which is fine because you’ve got to build your tribe, right, but like at the end of the day, right, you’ve got the users that want to trade, it’s not going to be really important to them where those orders execute. So, all we need to do is kind of build some cryptographic certainty about that execution and route it through, you know, from Ethereum to Serum and somewhere else and back to Ethereum.

Laura Shin:

Okay. So, it sounds like I was right that the reason that you made Serum interoperable is like that’s kind of your strategy for getting activity.

Sam Bankman-Fried:

It’s a big on-roading thing. Like, right now everyone has MetaMask and no one has SolFlare. SolFlare is one of the most common Solana wallets, or Sollet or one of these, but not everyone has it obviously, but in DeFi at least everyone has MetaMask, and so a lot of this question is like, you know, what does interoperable mean? There’s a lot of different layers of this, but like step one is you start with some Ethereum in your MetaMask wallet and somehow you have to end up using this new chain, and like, or making use of it somehow, and maybe eventually everyone’s got Solana and everyone’s got SPL tokens in their wallet, and then this is like no longer like a crucial step, but like at step zero no one has them…

Laura Shin:

And we…

Sam Bankman-Fried:

And you have to get there.

Laura Shin:

And are you trying to get SPL tokens used in MetaMask?

Sam Bankman-Fried:

Well, there’s a lot of different approaches, and like, you know, we would certainly be super thrilled for MetaMask to support it. Like, that would be really amazing. There are other things you can do too though where you can build your own applications that can, you know, interface with MetaMask and can, you know, utilize the Ethereum that you have on it, which is what it’s doing right now. So, like right now the kind of first bridge that came out, it’s a Solana-based wallet, Sollet, but that you can hook up to your MetaMask account and have them talk to each other.

Laura Shin:

Oh, okay. Yeah. So, why don’t we just talk a little bit more about Serum. So, when people go on there, what will their experience be and like who are you trying to target? Because so Serum is like a more like a central order book type of experience rather than these automated market makers that have become very popular in DeFi. So, does that mean that you’ll attract a different type of trader or are you trying to attract the DeFi traders? Or you know, tell me…

Sam Bankman-Fried:

Right.

Laura Shin:

Yeah.

Sam Bankman-Fried:

It’s a good question, and the long answer, like the sort of like long vision for this like ultimately is sort of everything. Like, sort of ultimately the answer, as Anatoly said, is like can you get a significant fraction of DeFi and crypto and then like the world’s financial ecosystem, maybe the world’s technological ecosystem happening on chain? Like, it sort of…you can think pretty big here, but if you sort of then zoom in, it’s like all right. Well, sure. Like, what are the first steps? You know, I think that like the first thing that we sort of launched on Serum was a central limit order book. So, you know, sort of looks like a centralized exchange except that it’s not. It’s on chain, and I do think that that does attract a slightly different crowd of people. You know, it tends to attract people who trade significant volume and are looking for significant liquidity as opposed to people who are looking to stake or to get yield or to like, you know, put seed liquidity for their like illiquid token, you know, and not have to think about it, and so I think it’s like it is like a different crowd, and I think the reason we started with that is that it was like A, I think it’s one of the most powerful things. Like, if you look at where volume is in crypto like 90 percent of it’s on central limit order books, but B, it’s sort of a proof of like a, you know, a proof that this can do cool things. It’s like here is a thing that you can’t do on most other chains, and it’s done.

It’s here, and it works, and it’s sort of like a really good first product from that stance of being valuable, useful, and really demonstrating what can be done, but sort of going forward the next things that are going to be released, I mean, a lot of people are working on things, but the ones that I’m aware of that are like, you know, the closest to coming out are going to be a lot of things that allow you to build the pieces that are in the current Ethereum DeFi ecosystem on Solana and on Serum, and so the answer is pretty soon it’ll have both. It’ll have central limit order books. It’ll have AMMs. It’ll have borrow lending. It’ll sort of span both the like things you would see on a centralized exchange and the things you see in Ethereum-based DeFi, but they’re all on chain, which means they’re also all composable and interoperable, and so you can do things like take your AMM and have it, you know, instead of trading against it like directly, you could trade against it through an order book if you wanted. Like, the AMM can literally itself go provide on an order book, or you could take your borrow lending protocol and give either the order book or the AMM or both at once leverage by composing them on top of each other, and so all of these things grow even more powerful for having the other ones there, and I think like over the next month most of the things I just talked about are going to be, you know, live in the ecosystem.

Laura Shin:

And so, okay. So, now I understand because I guess I thought that Project Serum was just this one order book exchange, but then earlier in the beginning of this show you called it an ecosystem, and I thought why is he calling it an ecosystem?

Sam Bankman-Fried:

Right. Right. It…

Laura Shin:

But now I see because you’re launching like these AMMs or lending protocol or whatever these other kind of DeFi like things, but within Serum. Oh, interesting. Well, so one thing, you know, just to go back to what I was asking in terms of like the type of person who would use Project Serum. You know, I saw that high frequency trading firm, Jump Trading, is going to market making on Project Serum, and I wondered how did that deal come together? They’re, first of all, a veteran of market making, but they also have this investment arm that’s active in crypto, and I just wondered, you know, did you reach out to them or did they reach out to you and like what was the appeal for them?

Sam Bankman-Fried:

Yeah. I mean, you know, we sort of had conversations about things, you know, related to crypto for the last couple years. We got, you know, got back in contact around this, and I think basically we had a similar vision, and I think we both had the vision of like thinking about what’s the biggest thing and the highest upside thing you can build as opposed to what’s the next step from where we are? And that just like really that points you in a very different direction because if your goal is to get like, you know, lower cost AMMs, right, then you’re like we just need another factor of 20 in throughput or in lower costs, and that’ll be fine, you know? Whereas if you’re saying like all right. So, step like three out of five is going to be trying to get like, you know, capacity for our, you know, a third of the world’s financial ecosystem potentially to be on the ecosystem. All of a sudden that factor of 30 isn’t looking so good. Like, it’s like a factor of three million, you know? It’s like just orders of magnitude upon orders of magnitude bigger, what you’re demanding here, and like sure. That’s sort of like a ridiculously lofty goal, although I think it is a real reach goal, but you don’t have to have that lofty of a goal if literally your entire goal is to have a well-functioning efficient order book with a matching engine on chain, that alone prices out almost every chain in crypto, and you know, like you see like a single Serum order book right now is using like way more, you know, way more throughput than the entire Ethereum network is, and so, you know, we sort of like both had the same thought of like you can’t go moderately big and still expect this to be scalable. You need to go really big. You need to really care about scalability, and you need to have the product vision to get there, and you need to have the like resources and wherewithal and knowledge and partners to have a plausible shot at building out so much of this, and then to go over to something both you and Anatoly have echoed. Like, almost every chain other than Ethereum is a ghost town right now. I mean, it’s sort of like a relative statement, but there’s just like…

Laura Shin:

Well, except for Bitcoin.

Sam Bankman-Fried:

Except for…right, but well, it’s interesting.

Laura Shin:

Don’t forget about Bitcoin.

Sam Bankman-Fried:

Bitcoin itself is super active.

Anatoly Yakovenko:

Yeah.

Sam Bankman-Fried:

There’s sort of not much built on top of Bitcoin, but Bitcoin itself the chain is obviously like the biggest by far.

Laura Shin:

Yeah.

Sam Bankman-Fried:

Yeah, but in terms of like smart contract platforms. In terms of platforms where the goal is for other people to build applications that run on it, everything’s on Ethereum. You know, Tron is number two with like probably one percent of Ethereum, or five percent maybe, and then the one after that’s going to have like, you know, five percent of that, and it’s just like there’s nothing, and so team after team has failed, and it sort of has demonstrated that doing something isn’t enough. You need to build something so cool and so impressive and powerful without requiring first having everyone move over, that you can create a compelling enough pitch that someone’s going to bother trying it in the first place, you know? That’s a high bar.

Laura Shin:

Yeah. Well, a couple of things that I wanted to ask. First of all, because I wasn’t totally sure about this. So, I’m assuming that your DEX will handle non-Ethereum assets as well?

Sam Bankman-Fried:

Yeah.

Laura Shin:

And so, I just wondered like when people trade tokens from different chains that have, you know, different consensus mechanisms, different block times, different levels of finality, how do you guys handle that? And like I also wanted to try to place this in the kind of world of like Polkadot versus Cosmos. Like, is this…it sounds like this is also a potential solution to that interoperability issue that they’re trying to tackle.

Sam Bankman-Fried:

Right. So, it’s a really good question, and there’s basically two ways that you can try and think of this, and two sort of paradigms, and one paradigm is a cross chain swap where the order book is literally listing a Bitcoin, or let’s get rid of, like Bitcoin’s a little funky, but it’s listing, you know, USDC against DOT, you know? Like, two totally…you know, a token on Ethereum versus like, you know, Polkadot, and it needs to, you know, to transact those two when two people trade, and there’s a lot of ways to try and settle this, but as you say, it’s a little bit nasty, right? Like, you have to deeply understand both consensus protocols. It’s only going to be as fast as the slower of them certainly. Like, you’re not going to be able settle this until both have settled. So, if one’s side Bitcoin then like it’s going to take half an hour to settle anything here, and you need to build in these really complicated processes to deal with like the fact that none of these things can natively talk to each other, and so like how do you know if someone delivered? Like, let’s say, you know, how do you make sure that it’s not like one person sends their funds and the other one just never does? And you can do it, but it is nasty. This is sort of what layers-2 do. Like, this is a lot of building a layer-2 is sort of solving this problem in a very specific instance of like your kind of customized, semi-centralized layer-2 versus Ethereum, often only in one direction, but you can generalize that. It is doable. It’s extremely finicky. Like, the pseudo-code specs for this, it’s like a 10-page document, and we didn’t even cover all the…like there’s some cases where like this edge case. We solved it. We’re not going to write down here. It’s too annoying, and like it’s because you have to fucking think of everything, right? You’re like, you know, every…

Laura Shin:

I know.

Sam Bankman-Fried:

Edge case of every chain, and you can do it. You can do it, but it is like really annoying, and it’s really hard…

Laura Shin:

I know. That’s what I was thinking. Like, how are they going to…I was just like, it just sounds like so much work.

Sam Bankman-Fried:

Right.

Anatoly Yakovenko:

Exchanges do this. Exchanges do this like every day, right? They accept DOTs and they issue Bitcoin and people are able…and they run, right? Most of the time.

Sam Bankman-Fried:

Well, and the whole, that most of the time it’s a whole fucking thing, right? It’s actually really easy to do this if it only needs to work like 98 percent of the time, right, because you just like build a node on both chains. The problem of course is like what you, like what’s it mean if one f*cks up or lies? Like, how do you deal with that in like a decentralized permissionless way? And that’s like with centralized exchanges there’s this like, you know, kind of wild card you can play, which is like all right. No longer decentralized. We’re going to have a human go look at it and figure out what happened and fix it and like with FTX, we have to do this every day like 20 times a day. Like, you know, some transaction will run into some weird error, but like halfway through it ran out of gas in like some non-usual way, and so it gets canceled but in a way that like our automated systems didn’t predict, and we just get this alert like something’s weird here. I can try to guess, but I might not get it right. Like, humans go look at this and make sure the right thing happens, and like that’s a thing that’s really hard to do with a DEX. Like, the whole point of a DEX is not to have that. So, you can do it, but you have to automate every single edge case. So, okay, taking a step back. This is something we’re aiming for, but this is like a many months project, and many months just to get two specific chains to work with each other, and every time you need to add a new chain there’s like another month of ironing out that chain. There’s another way to do this though, which is more modularized where instead of having the order book trade an ERC-20 USDC against, you know, a Polkadot DOT token, you can have bridges, and so one thing you can imagine this instead is there’s this, you know, Serum ecosystem on Solana and you draw a circle around it, and in order to enter it there’s like a wrapping process that happens there where, you know, you send in your ERC-20 token and you wrap it into an SPL token, which is a Solana token, that’s like fungible 1-to-1 with it, and then the DEX itself is just trading all these wrappers against each other, and so the nice…

Laura Shin:

Right. Okay.

Sam Bankman-Fried:

Yeah. It lets you kind of separate these processes, and it means that like the entire matching engine isn’t dependent each step on like understanding three blockchains, and this takes a lot of the pressure off of the system. So, the thing that we have right now is just like there’s one bridge which is live and there’s more which are going to be coming live soon, which are just like a way to wrap and unwrap tokens on them.

Laura Shin:

And okay, and so you keep saying wrap, but like for Wrapped Bitcoin on Ethereum that’s using a trusted third-party provider to do that, but are you saying this will be done via a smart contract in a trustless manner?

Sam Bankman-Fried:

Yeah, and now you get to what exactly trustless means, and sort of the real answer here is that it’s not a binary. It’s sort of a spectrum, and a lot of the things that sort of present themselves as such, they’re somewhere on the spectrum, right, and WBTC is sort of like generally known to be on the centralized end of this where like it’s just a custodian. You know, it’s BitGo. Then you have things like, you know, renBTC, tBTC, which are very sort of like more decentralized ways of doing this. You can imagine close to one end if you have all of the validators of a blockchain validating these cross-chain transactions, then they’re sort of validated with the full weight of the consensus, and so one more thing you can do, right, is if you take two chains and you get every validator or block producer or whatever they use on each side to be, with sort of the same consensus thresholds, to be validating that the swapping is happening, then that’s like pretty decentralized, you know? That’s like even more decentralized than just getting like 10,000 friends and strangers together and having them vote, which is what a lot of these things, you know, it’s sort of a lot of matching in the middle, but basically it’s like decentralized but not trustless. Like, you have to trust. You just you don’t rely on one person. You have to trust that like, you know, most of 10,000 people are sort of honest.

On the far end, there’s something even stronger you can do, which is sort of the like fully, the most trustless version where you’re actually running like clients, which is to say you pre-program into each blockchain exactly how the other blockchain works so that you can feed them raw blockchain data and they can figure out what’s going on on, you know, the on-chain program does, and so you don’t have to have people voting on what happened in the blockchain. It’s sort of pre-programmed, but then, again, you have to think very hard about what happens if there’s like a fork that like this program didn’t anticipate, and so that’s sort of like as far as you can get here, and yeah. There’s just sort of this spectrum of these bridges, and I think that like the sort of like standard first place to start is like a multisig. You know, you have like, rather than like a BitGo custodian, you have like, you know, a group of people who are multisig that, you know, that are sort of like validating, you know, each running nodes and validating that like these swaps are happening correctly.

Laura Shin:

Okay.

Sam Bankman-Fried:

And so, that’s like one version of a thing that you can do. Anatoly also actually has like more information I think on the most recent state of some of these bridges than I do. So, I’m going off of like two-month-old information about what was going to be rolled out when, but…

Anatoly Yakovenko:

Yeah. So, like Sam basically nailed it. Like, the way I think about it is effectively like custody, like and you have a spectrum of centralized custody like Wrapped BTC, right, or what you deposit into an exchange and it gives you a virtual token on their exchange to trade with, right, to something that’s like in the middle where like it’s like tBTC, like REN, and then you have something farther to the right of decentralization like proof of stake networks where you have, you know, you have finality, right, that’s controlled by some set of validators that are signing things. So, you know, imagine these validators all colluded and like manufactured fake headers. That’s no different than like any custodian, right, kind of like running away with the funds that you’ve trusted them. So, this kind of spectrum of decentralized custody goes all the way to full blockchains like clients running inside each other, and Cosmos, like as you mentioned, their spec IBC kind of covers all the corner cases of like what happens if chain one forks, or both forks at the same time, right? Like, who actually gets what? And fundamentally like I think the interesting thing there is that many…like the combination of these methods are probably what’s going to be used by consumers.

Like, when a user deposits something like hey, I want to bridge, you know, Yearn from Ethereum to Solana and trade it on Serum. They can do the deposit against a Litecoin and somebody could basically run it through a multisig and issue them the token and take the slow path for a fee, right? They basically okay, I’ll wait for full finality for like, you know, 0.001 percent for you, but you can go trade Yearn right now, right? Like, because as soon as you have like risk, right, if you have like opportunity for risk and speed, right, and finance there’s opportunity to make yield there, and somebody will take the other side of that. So, users actually will probably be able to always kind of see a fast path and underneath, behind all this is like how do we reduce settlement risk? How do we make this more decentralized, more censorship resistant? That’s almost like all backend work that users are really unlikely at the end of the day to deal with.

Laura Shin:

Okay. Oh, this is really interesting. So, something else that I wanted to ask about was Serum has two tokens, SRM and MSRM, and why don’t you just describe what the purpose is for each?

Sam Bankman-Fried:

Yeah. So, Serum is sort of the fundamental one, and like for most things you can sort of ignore MSRM. So, Serum is, you know, what does it do? It does, I mean, the first answer is it’s a governance token, and so it can vote itself to do more things, but you know, currently what’s it do? So, first of all, 100 percent of all the revenue from Serum, you know, from all the projects on Serum, they go to the Serum token, and so, you know, this means like exchange fees, you know, go to Serum, whether it’s through a buy and burn, whether it’s through yield, and that’s, again, it’s sort of like up to the Serum tokens to decide how they want that. So, they sort of control all of that and gaining from all of that. They also are the governances. So, they can vote to, you know, changes fee rates and things like that. And then the other thing that they do is there’s a staking system and a node system, and the nodes basically manage a lot of the processes that go on on Serum, and so in particular like you can get some extra oomph out of on-chain stuff if you’re able to have people staring at it and poking at it, and what does that mean? You know, I’ll give an example. So, all of the borrow lending protocols on Ethereum, how do they deal with liquidations? Like, what’s, you know, let’s say someone’s about to go bankrupt, what happens? It doesn’t…

Laura Shin:

There’s like keepers that kind of find something that looks like it’s kind of running under the collateralization ratio or something. Is that what you’re talking about?

Sam Bankman-Fried:

It’s like, yeah, it’s sort of like that. Blockchains aren’t very good at like, you know, they sort of just like keep sitting there doing what they’re doing, and what they sort of…the natural way to mechanic something like liquidation, which is what most people do, is at any point anyone can try and liquidate someone. So, I could see your account and I would be like oh, man. There’s Laura’s account. I’m going to try and liquidate her. So, I like, you know, type in, you know, I send to command should I liquidate Laura? And the borrow lending protocol is like no. Fuck you, Sam. She’s nowhere near her margin limits. Like, obviously she can’t be liquidated, and just like whenever I send that command it goes in tests, but if you are in fact below your margin limits and I send the liquidate command, then it liquidates you, and what’s it mean to liquidate you? Well, somehow it has to do with this fact that you’ve got all of these positions and assets and stuff and they got to go somewhere. So, what it actually means to liquidate someone is you volunteer to take that, and so actually what happens is like I claim Laura’s like below margin limits and like I’m going to take her portfolio on, and I send that to the blockchain and it validates it, and that’s sort of like an example of like an external actor who comes in to help the system in a way where like they can’t sort of do anything terrible because the code, you know, the blockchain code just won’t let them liquidate someone if they’re not below margin, but there’s a function that needs to be filled and realized on someone like that.

So, that in particular is actually quite an intense and scary thing to put on someone’s shoulders because they might be taking on a huge position, but there’s a lot of sort of like less scary versions of that that are important for maintenance of stuff on Serum, and so to give some examples. You know, one of them is, you know, there are certain times when like some sort of queue is filling up. Like, you know, some there’s some like data structures like, you know, a queue of all the trades that have happened recently or something, and you need to clear that out periodically or else it’s like the DEX just halts. It’s like all right. We’re out of space. Like, there’s nowhere for me to write this. I’m just like sitting there like pleading with someone to like realize that happened and like clear out this buffer, and as soon as someone does it just starts running again, and so that’s like sort of an example of a node duty on Serum is like watching for all of these things and like taking care of them when they need to be taken care of, and what they share in common is that you can’t like steal anyone’s money this way. It’s not like giving a superpower to these nodes that lets them like screw anything up. It’s just like, you know, a task that needs to be done and like waiting for someone to do it. So, that’s one example of it, and basically it’s, you know, Serum holders who are staking to these nodes, which are then performing these like on-chain duties, and another thing you could think about is like validating cross-chain transactions. So, you know, for a lot of these bridges like who are natural people to be validating that that swap happened correctly? One, like the Solana validators is one answer and the, you know, Serum nodes is another. So, okay. So, that’s sort of Serum. It’s basically like economic, you know, gain from everything that happens on Serum, governance of it, and then staking for maintenance of it, and plus, you know, whatever else people do with it. I haven’t yet gotten to MegaSerum, but that’s sort of like, you know, that’s background.

So, okay. What is MegaSerum? So, MSRM, which is MegaSerum, is I think a super, super cute thing. I’m really happy with it. It’s a wrapper on a million Serum. So, you can take a MegaSerum and just crack it open and get a million Serum out. You can take a million Serum. You can wrap them together and get a MegaSerum. So far it seems kind of stupid, like who cares? Well, here’s why you care. First of all, it’s a little bit better than a million serum. So, you get like, you know, so you get a fee discounts for holding Serum when you trade. You get like bigger fee discounts for having a MegaSerum than you do for a million Serum, and like in all of these various ways you get like little bonuses for having a MegaSerum, and in addition each of the nodes, which is like, you know, voting and managing these processes, in order to form it it has to have a MegaSerum staked into it. So, it can have…you can stake to it with just Serum. Like, you can collect a lot of people with that, but at least one person has to activate it with like by staking their MegaSerum to it.

So, now you’re like okay, this is still stupid because everyone just obviously creates MegaSerum because it’s better, and now I get to the second core part of MegaSerum, which is that they’re scarce. So, there can only be 1,000 MegaSerum in the world ever, which could only soak up 10 percent of the Serum, and so basically what they are, they’re almost like NFT like in a way. I mean, they’re fungible with 10,000 of them, but you know, it’s like a sort of, you know, wrapper on a million Serum that’s like a bit better and allows you to activate a node, but they’re scarce. You know, it’s not that everyone can do them, and you know, you can trade these, and so if you’re just looking to like have some Serum in your wallet because you’re, you know, buying in and selling a lot like, you know, you’d just stick with Serum, and if you ever got a MegaSerum you’d probably sell it, and the reason you’d sell it is you’d sell to someone who would probably be willing to pay more than a million Serum for it because they really want to be able to activate their node, and you can only do that with one of these, and the world’s out of them. So, that’s basically what a MegaSerum is.

Laura Shin:

Yeah. It’s like flying business class or something. It’s like limited number of seats, but you get these extra perks and yeah, or I don’t play videogames, but I imagine like some kind of special videogame level that, you know, you can achieve, and yeah.

Sam Bankman-Fried:

Exactly, and it’s like in practice it’s the sort of thing where if you’re like a really core member of the Serum ecosystem and want to do a lot of stuff there like most of them are like very excited to have a MegaSerum because it like allows you to do more stuff, whereas if you’re just sort of like coming in and out and doing some trades sometimes and like buying, you know, trading for Serum for profit back and forth like, you know, you sort of wouldn’t bother getting the like, you know, long-term gold chart or whatever.

Laura Shin:

All right. So, we’ve covered I think pretty much most of the aspects of Solana and Serum, but I just did wonder, you know, going forward like what are kind of the next milestones and what are some of the new things that we should be watching you guys for in terms of what you’ll be rolling out?

Sam Bankman-Fried:

Yeah. So, on the Serum end, I mean, a lot of people are building things and we’ll see what comes through. I’m super excited for a lot of them. There are also some which I can’t say yet, but I’m super excited about, but the two things that I’m most excited about that are going to be coming out soon which are just unlock so much. One of them is a borrow lending protocol and a bunch of people are working on those and sometime in the next month one’s going to go live, and that’s going to enable borrowing and lending but also margin and futures and leverage and everything like that because you can just compose it with anything. The other thing which is the more unique thing is a thing called pools, which are going to be coming out in the next week, and a pool is a really, really cool kind of primitive structure, and it’s sort of the common element between an AMM, wrapping, staking, borrow lending, and a ton of other things in DeFi. What it is is a fully customizable way to have like this pool of assets and these tokens that represent ownership of them, and so…

Laura Shin:

Is it like Balancer? It sounds like Balancer.

Sam Bankman-Fried:

Yeah. That’s like another example. It’s like a more customized example where, you know, with Balancer you have these Balancer, you know, Balancer pool tokens which represent ownership of the pool of assets in the Balancer pool, and you know, you can kind of like create and redeem them, and then separately there’s this other thing where you can like trade against these Balancer pools using the sort of AMM curve like thing, and so that’s like a more generalized version of Uniswap. Uniswap was also a pool, but it’s like, you know, a more restricted one because there are only two assets in it. The fully generalized pool, so you can specify everything from…you can sort of do whatever you want with them, and so, you know, you could just write a program to control each piece of it, and what that means is that you could take a pool and with the address that controls the assets you could write it such that it took the assets and provided liquidity on a DEX with them, and so if you wanted to you could have this pool that like instead of AMMing, it sort of like replicated that curve but did it by providing on a DEX, or you could build a pool with where it’s just an AMM with any arbitrary curve of like, you know, instead of this X times Y equals K thing, it could be any function in the world. You just write it down on chain and put it in the address and then that’s what it’ll do, and you can control what you need to put in to create shares in the pool. You can control what you get out for redeeming them. You can customize both of those, and so in its very simplest form it’s just a staking thing or like an ETF or something like that. You put assets in, you get ownership out, and then you can crack that open, but you can customize what happens with each piece of it, and it just makes it super clean and straight forward to roll out a really large number of protocols, and so I’m really excited for that to unlock a lot of projects at once, and that’s going to be coming out, you know, in the next week.

Laura Shin:

Okay. All right. Well, this has been super interesting. Where can people learn more about each of you and Solana and Project Serum?

Anatoly Yakovenko:

Well, Solana.com. Just go there, or if you’ve…there’s a ton of documentation about like just kind of design and as well as developer docs, but jump into our Discord. Like, we’re friendly people. So…

Laura Shin:

And Sam?

Sam Bankman-Fried:

Yeah. It’s…oh, God. There are so many places. So, if you go to…and they all link to each other which is good, but you can go to ProjectSerum.com to see sort of an ecosystem website. You can go to our Discord. You can go to our Telegram channel. You can go to our Twitter account. Follow me on Twitter. All of those like all roads lead to Serum, so to speak.

Laura Shin:

Okay. Great. Well, thank you both so much for coming on Unchained.

Sam Bankman-Fried:

Of course. Thanks for having us.

Anatoly Yakovenko:

Yeah. Thank you.

Laura Shin:

Thanks so much for joining us today. To learn more about Sam and Anatoly, Solana and Serum, check out the show notes for this episode. Don’t forget you can now watch video recordings of the episodes on the Unchained YouTube channel. Go to YouTube.com/c/UnchainedPodcast and subscribe today. Unchained is produced by me, Laura Shin, with help from Anthony Yoon, Daniel Nuss, Bossi Baker, and the team at CLK Transcription. Thanks for listening. Okay.