August 12, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

- The Poly Network hacker has returned nearly all of the $600M in funds they stole earlier this week.

- TaxBit, a crypto tax software company, closed a $130M Series B at a valuation of $1.33B.

- Soccer star Lionel Messi’s new contract with Paris St. Germain includes cryptocurrency fan tokens.

- Ethereum burned over $100M worth of ETH in its first week following its London upgrade.

- Representative Anna Eshoo penned a letter to Speaker Nancy Pelosi advocating to amend the crypto tax provision in the infrastructure bill.

- Kryptoin filed for an Ethereum ETF on Thursday.

- Dune Analytics, a blockchain analytics firm, raised $8M in funding through a Series A.

What Do You Meme?

What’s Poppin’?

Call it a fad, call it a bubble, NFTs are still here, and the headlines are not getting any less head-scratching. One caught my attention this week as especially, shall I say, *interesting.*

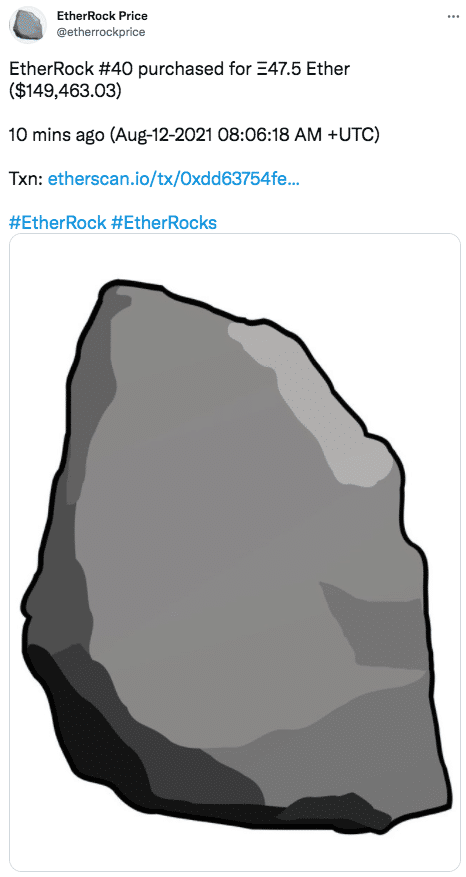

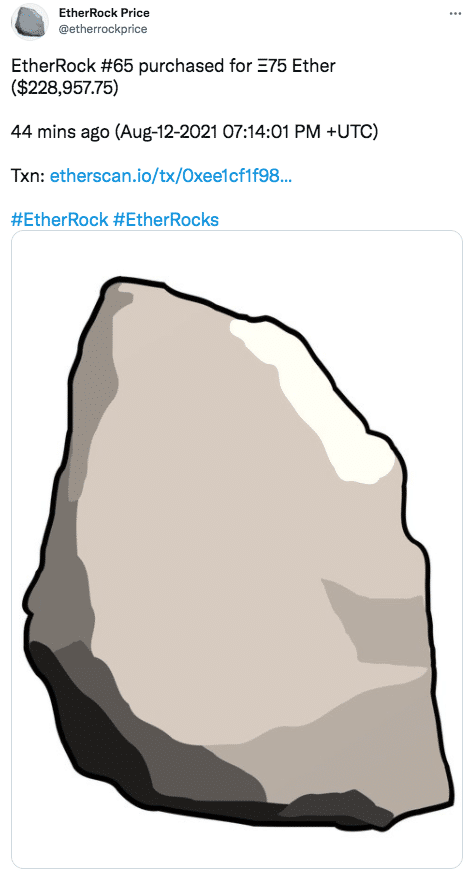

Case in point: EtherRock #65 sold for roughly $228K yesterday afternoon. Just a few hours earlier EtherRock #40 sold for around $150K.

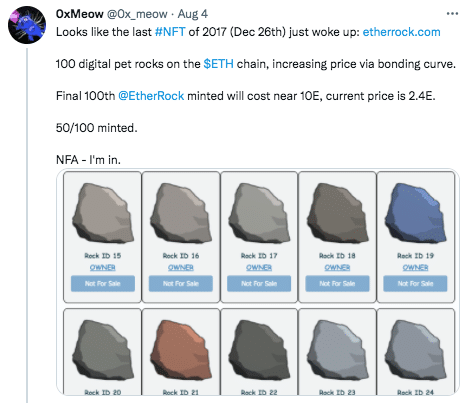

EtherRock is an early NFT project consisting of 100 NFT images depicting, well, identical rocks — each with its own (slightly) distinct color. The website, of course, specifically explains that the pet rock-inspired project serves “NO PURPOSE” outside of being able to be bought and sold.

The project, which launched in 2017, was, ahem, unearthed just over a week ago by Ethereum users. Enthusiasm for the early-NFT project was quick to catch on: after minting half of the rocks over a three year span, the remaining 50 rocks were minted in a single day, with each subsequent mint growing more expensive than the last, thanks to the design of EtherRock’s smart contract.

Yesterday’s sales are the culmination of a busy week of trading for EtherRocks. The first big purchase occurred last Friday, for 15 ETH ($45K). Since then, according to the EtherRock Twitter feed, nearly a quarter of the collection has been purchased on the secondary market. At publishing time, the highest rock sale sits at 96 ETH ($300K+).

What a time to be alive.

Recommended Reads

- Alex Gladstein on Cuba and Bitcoin:

- a16z’s Chris Dixon on Web 3:

- Kevin Werbach, a Wharton professor, on DeFi and regulation:

On The Pod…

-

how Poly Network works

-

what specific mechanism the hacker attacked on Poly Network

-

why many people (including myself) had never heard of Poly Network before the hack

-

how “keepers” failed to protect Poly Network

-

why a failed transaction was the key to pulling off the hack

-

what SlowMist claims to have discovered about the hacker

-

what could be motivating the hacker to return the stolen funds

-

how the hacker is communicating with Poly Network

-

why Tether was able to freeze funds while USDC and BSC allowed the hacker to get away with their tokens

-

how Poly Network should handle negotiations with the hacker

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians