January 4, 2022 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

LinksDAO raised $10 million in ETH through NFT sales and plans to use the funds to purchase a golf course.

-

The Boston Fed is looking to hire a director for a CBDC project.

-

Bitcoin’s hash rate hit an all-time high on Jan. 2.

-

Convex Finance crossed $20 billion in TVL.

-

Samsung TVs will now support NFTs.

-

A Mutant Ape Yacht Club serum sold for nearly $6 million.

-

A presidential candidate in South Korea is raising money via NFTs.

- Estonia is circulating a series of FAQs regarding recently approved crypto legislation.

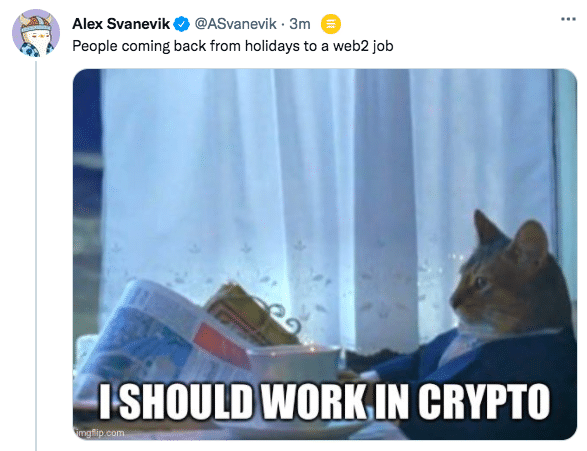

What Do You Meme?

What’s Poppin’?

The CFTC Strikes Early in 2022

Polymarket, a blockchain-based predictions protocol (and disclosure: a previous sponsor), has settled with the US Commodity Futures Trading Commission via a $1.4 million fine. In addition, Polymarket will begin to wind down non-compliant operations by late January and “cease and desist from violating the CEA and CFTC regulations, as charged.”

The regulator says that Polymarket offered “off-exchange event-based binary options contracts” and failed “to obtain designation as a designated contract market (DCM) or registration as a swap execution facility (SEF).”

Polymarket is a predictions market that allows users to bet “yes” or “no” on certain events happening via smart contracts (and using USDC). In its statement, the CFTC pointed to markets on whether Trump would win the 2020 presidential election or whether ETH would be over $2500 by July 22, 2021. According to the CFTC, Polymarket has offered more than 900 such events to bet on since its inception.

“All derivatives markets must operate within the bounds of the law regardless of the technology used, and particularly including those in the so-called decentralized finance or ‘DeFi’ space,” said Acting Director of Enforcement Vincent McGonagle in a press release from the CFTC. “Market participants should proactively engage with the CFTC to ensure that our markets remain robust, transparent, and afford customers the protection provided under the CEA and our regulations.”

On Polymarket’s side, it appears they are cooperating, as evidenced by this quote from the CFTC’s statement: “As stated in the order, the CFTC recognizes Polymarket’s substantial cooperation with the Division of Enforcement’s investigation of this matter in the form of a reduced civil monetary penalty.”

On Twitter, Polymarket reiterated that it will continue working with the regulator. “We’re pleased to confirm that we’ve successfully agreed to a settlement with the CFTC, & are excited to move forward & focus on the future of Polymarket. As per the order, the 3 markets lasting past 1/14 that don’t comply with the Act will be prematurely resolved. More soon.”

Speaking of Twitter, Collins Belton, founding partner at Brookwood P.C., called the CFTC the order the “most relevant and telling regulatory actions for DeFi founders and investors yet.” According to Belton, the CFTC alluded to the “potential” of AMMs being “algorithmic” rather than a “platform or exchange,” meaning that not all AMMs (like Uniswap or SushiSwap) would need to register as a licensed market with a regulator.

Furthermore, Belton says the order is significant because it highlights the importance of having a decentralized front end. Wrote Belton, “CFTC highlights how @PolymarketHQ users are functionally entirely dependent on their [front end] to access the smart contracts, despite non-custodial wallets.’ He added, “If your [front end] is the only means of accessing your platform, regulators have strong incentive to bring you under their regulatory ambit.”

The announcement from the CFTC is its first enforcement action of 2022 and comes just a few months after it was first reported that the regulator was looking into Polymarket.

Recommended Reads

- @cobie on web3: https://cobie.substack.com/p/wtf-is-web3

- Not Boring on web3: https://cobie.substack.com/p/wtf-is-web3

- Lyn Alden on the Bitcoin genesis block: https://twitter.com/LynAldenContact/status/1478107171111976965

On The Pod…

Crypto 2022 Outlook: Where Will the Markets Go This Year? Plus DeFi and NFTs

Larry Cermak, VP of research at The Block, and Igor Igamberdiev, director of research and data at The Block, recap the most significant trends of 2021 (BTC mining, L1s, NFTs, DeFi, venture funding) and discuss what might happen in 2022. Show topics:

-

why 2021 was so significant for the crypto industry

-

why the crypto markets didn’t see a blow-off top at the end of the calendar year the way they typically do about a year after a Bitcoin halving

-

what Larry thinks about whether the crypto market is in a supercycle

-

how the state of BTC and ETH mining changed in the past year

-

why Igor thinks multichain technology was key to a record-breaking year for venture capital entering the crypto space in 2021

-

how the layer 1 (L1) ecosystem wars played out in 2021 and what it could look like in 2022

-

what Larry and Igor think of Ethereum layer 2s (L2s)

-

how Ethereum’s shift to 2.0 could affect the L1 race

-

what Larry thinks about DeFi tokens going into 2022

-

how DeFi trends, like decentralized exchange volume and lending, played out in 2021

-

why Igor thinks KYC-DeFi (know-your-customer decentralized finance) is inevitable

-

what Larry thinks about NFTs going in 2022 and why he thinks PFPs are dead

-

Larry and Igor’s outlook on the metaverse going into the new year

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Feb. 22. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians